-1.png)

Gold/Silver: Raise your stops and enjoy this bullish pennant

Posted: March 31, 2023, 12:46 p.m.

Precious Metals diverged this week from other safe-haven assets and showed incredible performance against the U.S. Dollar, Japanese Yen, and Treasuries as the market casts doubt that the Fed will continue down its hawkish path. The banking crisis was last week's news item, and global risk sentiment improved, driving the Nasdaq back into breakout territory. The U.S. Dollar reached a one-week low and helped slow the sell-off in the Gold market, allowing traders to re-enter back to the long side with tight stops below the 38.2% Fibonacci from the recent contract highs. Having the flexibility to enter and exit the market quickly makes it essential for Precious Metals investors to have a futures trading account alongside their core Physical Precious Metals holdings.

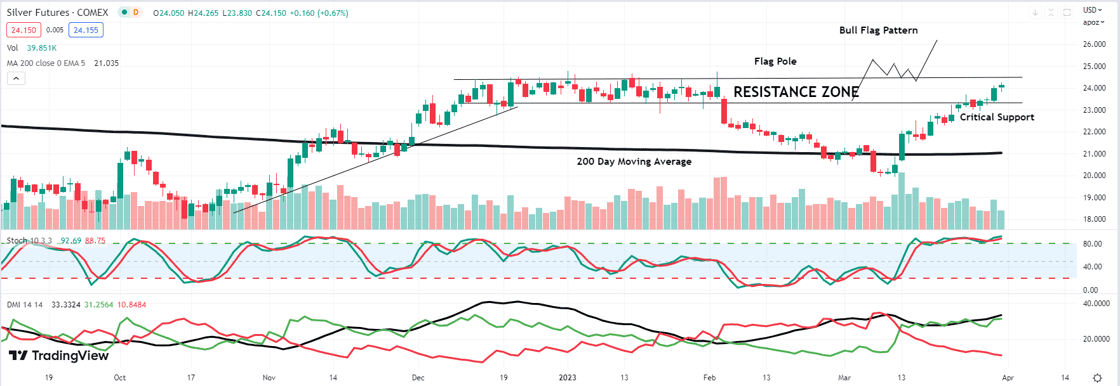

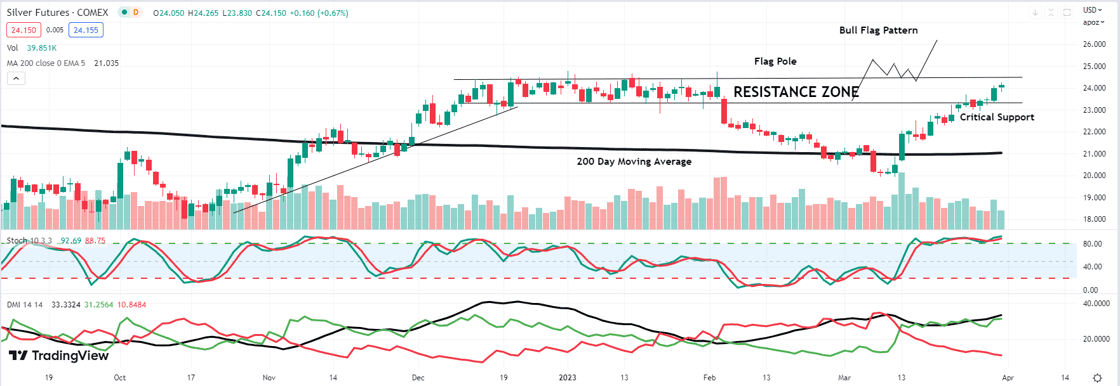

Daily May Silver Chart

The technical backdrop shows Silver shows an extension to a "Bull flag pattern" we identified several weeks back while continuing to achieve new swing highs and chewing through the consolidation seen from December through February. The first level of support is just below the March 30th low at $23.37, and the second critical support is at $22.96. We suggest using that level for "stop-loss" protection for clients currently long Silver. Looking at the stochastics, they have pushed into "over-bought" territory indicating that the current bull market is alive and well.

The technical backdrop shows Silver shows an extension to a "Bull flag pattern" we identified several weeks back while continuing to achieve new swing highs and chewing through the consolidation seen from December through February. The first level of support is just below the March 30th low at $23.37, and the second critical support is at $22.96. We suggest using that level for "stop-loss" protection for clients currently long Silver. Looking at the stochastics, they have pushed into "over-bought" territory indicating that the current bull market is alive and well.

To further help you develop a trading plan, I went back through 20 years of my trading strategies to create a Free New "5-Step Technical Analysis Guide to Gold that can easily apply to Silver." The guide will provide you with all the Technical analysis steps to create an actionable plan used as a foundation for entering and exiting the market. You can request yours here: 5-Step Technical Analysis Guide to Silver.

Daily June Gold Chart

The technical backdrop in Gold shows a crucial double bottom at $1835/oz, and the market is well above the 200 DMA at $1826/oz. Stochastics are rising into overbought territory, and DMI+ is crossing back over DMI- indicating a healthy mature bull market. A critical level we are watching is the March 21st low downward spike to 1955.9, now the first critical support. A break below 1955.9 will begin signaling a near-term failure. Therefore, we would be only cautiously Bullish and reevaluating upon such a move. For those working closely with us, most of you had re-entered the market on Monday's correction and are working stops below the $1955 level.

Our Strategy

The near-term macroeconomic backdrop is regaining upward momentum, while the long-term outlook should entail a series of rate cuts into the fourth quarter of 2023. We recommend that clients increase exposure in metals such as Copper, Platinum, and Silver while maintaining limited exposure to the Gold market with an exit strategy.

If you are interested in speculating on the rise and fall of the price of Precious Metals on a shorter-term basis, such as two weeks or two months, or If you have never traded futures or commodities, I just completed a new educational guide that answers all your questions on transferring your current investing skills into trading "real assets," such as the 1000 oz Silver futures contract. You can request yours here: Trade Metals, Transition your Experience Book.

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial