The Inflation Review With Consumer Prices, Producer Prices And Other Inflation Trends

Posted: March 24, 2023, 8:33 p.m.

The Inflation Review

"Don't follow the advice of others, rather, learn to listen to the voice within yourself." - Dogen

Chart Booklet & More

Access this week's chart booklet with CPI, PPI, and Breakeven Inflation Rates. We also cover in-depth corporate trends of Illumina, Intuit, and Pioneer Natural Resources. We will provide an updated chart book with more data on corporate trends when we release Triple Play Episode 12!

Bill Baruch joined CNBC's Halftime Report on Wednesday. He shared AMD as one of our top picks.

Triple Play Podcast

Don't miss episode 11 of our Triple Play Podcast! Bill Baruch and Jannis Meindl discuss the latest macro trends and share three actionable stock ideas.

The Inflation Review

Economic Data & Systemic Risks

After reflecting on last week's regional bank frenzy, we'll keep this one relatively contained to data released this week. The second section of today's writing briefly mentions why the ongoing duration mismatch is unlikely systemic. While probably not systemic, the recent events have further tightened lending appetite, which may translate into slower economic activity writ large.

In any case, we will entertain lending activity next week and reflect on whether the 2019 playbook is intact, as we indicated on Triple Play.

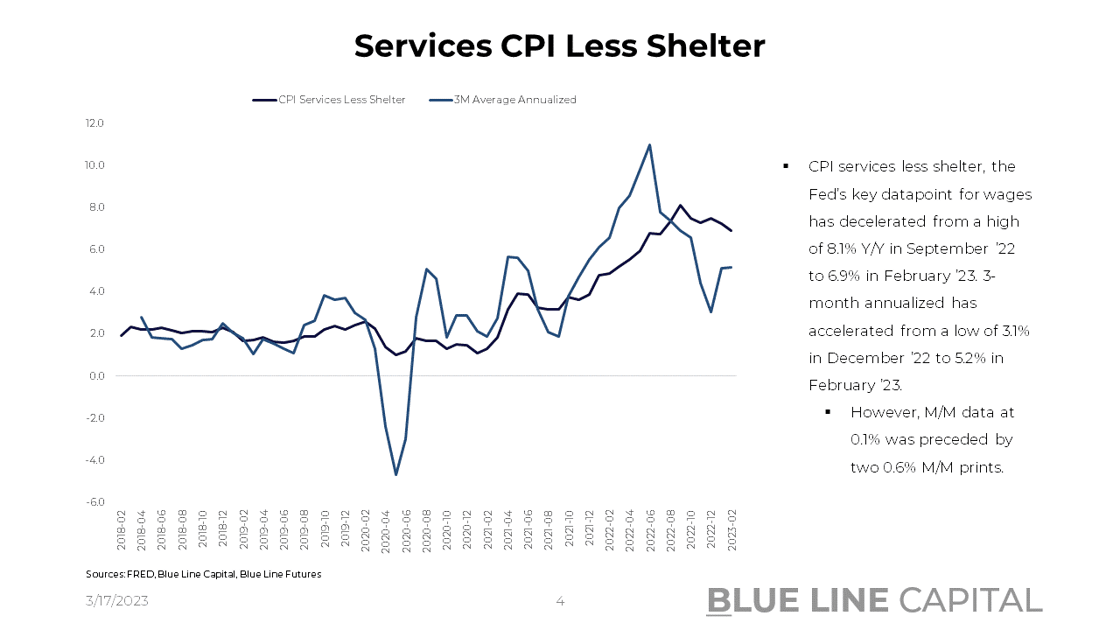

First and foremost, in a spout of uncertainty Gold went bid this week as treasuries rallied with equities selling off. Interestingly, High Yield (HYG) was only down 66 basis points 1 hour before the close on Friday, right in line with the Nasdaq 100 trading down by ~70 basis points. With the Russell 2000 leading lower, down about 264 basis points as of 2 pm CT, March 17, we are seeing a bifurcation in this market. The question is whether leadership from tech will be sufficient amidst a continued bleed in the banking space and the spillover effects into the economy. So far, consolidation of market share is happening in multiple areas of the economy - including banks and tech - which should translate into more bargaining power for businesses while wage inflation normalizes to a degree.

From pre-weekend moves to Fed meeting chatter, let's reflect on recent economic data and how it may affect the Fed's rationale on March 22.

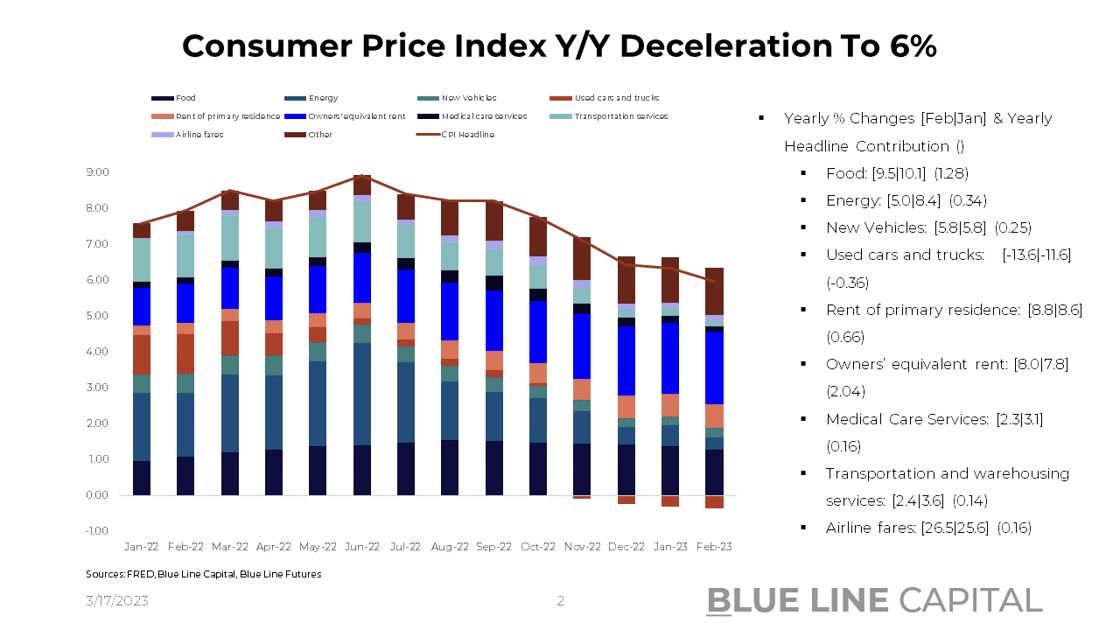

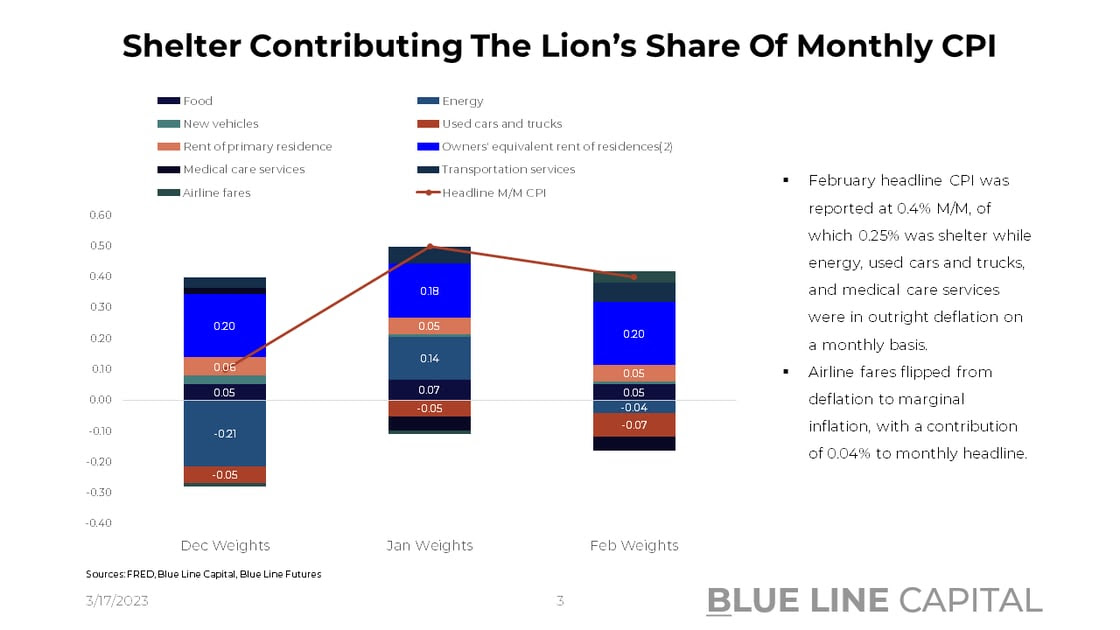

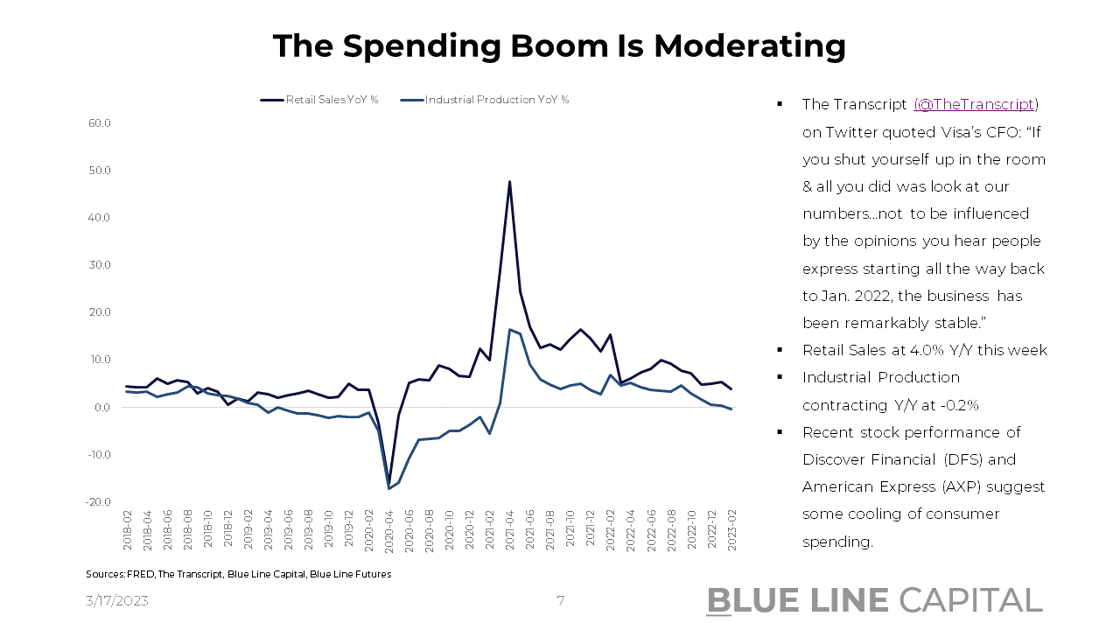

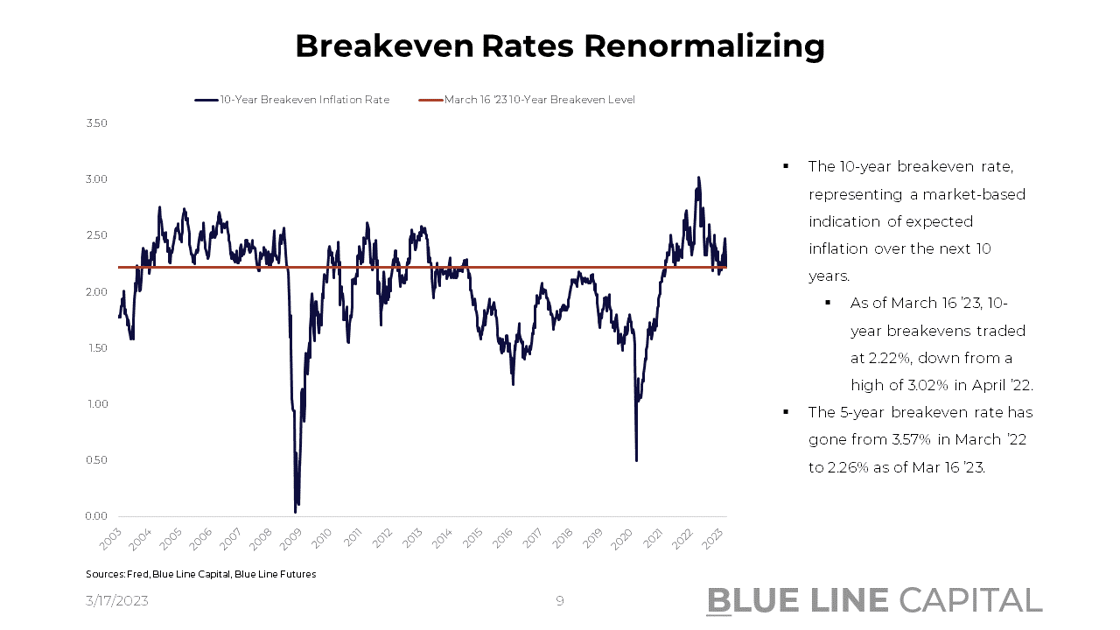

While the odds are the Fed will hike rates by 25bps with $160.2bn of lending from the Fed's discount window and new BTFP combined (@Nick Timiraos), markets will mostly watch Powell's response to recent financial stability concerns and the path of the data. If we trust recent CPI and PPI data, we see a straightforward way to lower inflation as the retail spending boom is slowly but surely moderating. As we talked about on Triple Play Episode 11, more consumers are transitioning into 30day+ delinquency, suggesting that consumer spending is normalizing. The normalization is also reflected in the stock prices of Discover Financial and American Express, two proxies for consumer health. Thus, despite upbeat commentary from Visa's CFO, spending above one's means appears less present in today's economy compared to the economy we had a couple of months ago. If spending moderation is indeed a reality, the Cleveland Inflation Nowcast at 5.22% Y/Y for March and breakeven rates paint a path to low rates and low growth.

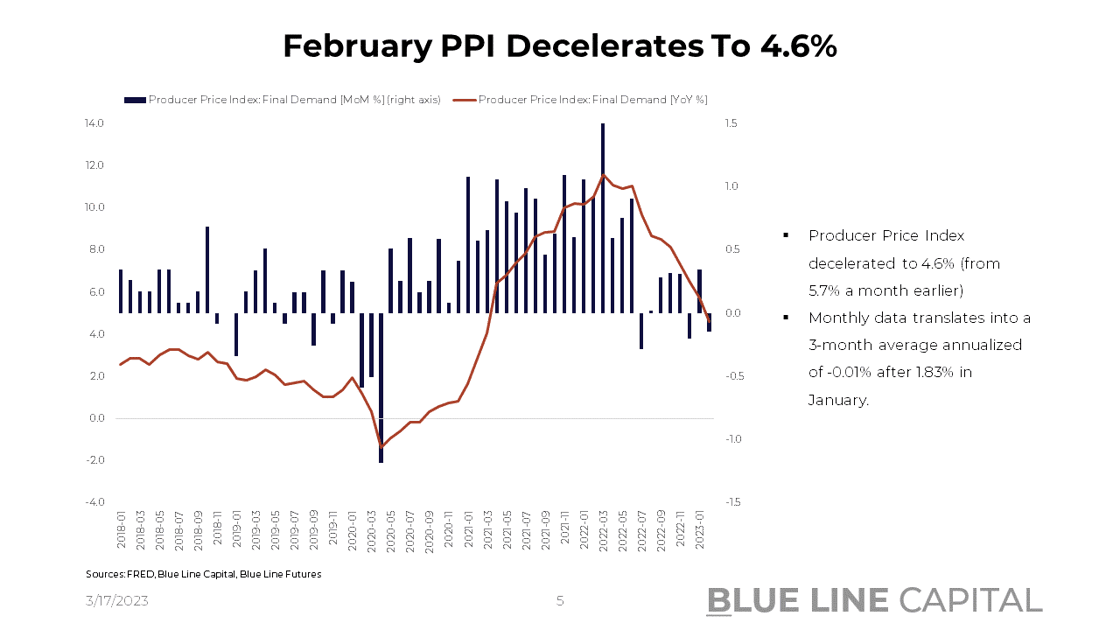

Additionally, this week's favorable data of CPI at 6% is not isolated but accompanied by producer prices, which have decelerated to 4.6% in February after 5.7% in January. On a 3-month annualized basis, PPI comes in at 1.83%, proving that the landing could be on the softish side. Using a Y/Y to a 3-month annualized comparison of PPI subcomponents, we notice that there's only one area, construction, with three month average annualized inflation exceeding 1% with stubbornly high prices at 16.2% Y/Y. As demographics and falling mortgage yields support home buyer activity despite the recent slowdown, construction may be a bright spot in this economy.

Retail Sales this week decelerated further to 4.0% Y/Y (down from 5.5% Y/Y), and industrial production was in outright contraction at -0.2% (down from 0.5% in January). Contrary to the deceleration of Retail Sales and Industrial Production, Atlanta GDP Now suggests 3.2% annualized GDP growth for Q1. Taking markets by their word, breakeven rates are erring on the side of retail sales and industrial production, telling us that the renormalization is for real.

Where Are The Systemic Risks?

Last week's note was about Silicon Valley Bank and whether there are systemic risks around the duration mismatch. On Triple Play, we argued that liquidity is distinct from solvency, and we are not talking about solvency barring an event that would genuinely stifle consumer spending and economic growth. While this is always a possibility, rates that have started to trend lower from their highs should mitigate some of the concerns around the refinancing needs of corporations and individuals. Thus, if our working assumption is that rates renormalize, debt gets refinanced, and we return to a 2019 world of low growth & inflation, many things are taken care of. But as we learn repeatedly, many possibilities and a myriad of counterfactuals didn't happen in history and thus went unrecorded.

What if rates stay higher for longer? As the renowned short-seller Jim Chanos suggested with Dan Nathan and Danny Moses, commercial real estate loans may be the next shoe to drop after current duration issues:

The regional banks are now under scrutiny; they now have another longer-term problem: their reliance on commercial real estate. The credit event, if that's in the future, is in commercial real estate, probably not long-term bonds at this point.

If you read last week's article, we included a chart covering the potential issues from the real estate sector as real estate credit on bank balance sheets has ballooned and not re-adjusted in value. Thus, the massive commercial real estate borrowing that has inevitably ended up with banks could eventually spur a transition from liquidity to solvency concerns.

While we're not in the game of forecasting tomorrow's weather, one has to wonder what structural drivers will push and pull on rates & growth in the economy. China appears to be disappointed as reopening demand stays rather weak, reflected in crude and copper prices, while the transitory element of fiscal here in the U.S. is slowly but surely waning off. While fiscal dominance needs to be an ongoing concern for all participants, how likely are immediate positive impulses as the US government tries to find a debt ceiling resolution? With significant concessions to be expected when passing new budgets, higher taxes may be one of the factors we need to entertain. However, if rates continue to turn lower, that debate may get pushed into the future, buying us more time against the inevitable reckoning.

Please find more information in our chart pack. All the weekly data releases will be covered in our daily Morning Express, authored by Bill Baruch.

Don't miss Episode 11 of our Triple Play Podcast -- Bill Baruch and Jannis Meindl share their thoughts on Morgan Stanley, United Health, and Adobe.

Chart-Pack Macro Slides

Stay tuned for Episode 12 of Triple Play!

Until next time, good luck & good trading.

Be sure to check out prior writing of Top Things to Watch this Week:

- Gaining Clarity In The Fog Of War (Silicon Valley Bank's Duration Wipeout) - Mar. 13, 2023

- 2023, A Macro Safari En-Route 2019 - Mar. 5, 2023

- The Fed's Preferred Inflation Indicator & Energy Markets - Feb. 27, 2023

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial