.png)

Gold/Silver: Reduce exposure, raise stops, and buy the dip

Posted: March 24, 2023, 1:07 p.m.

Volatility, Systematic risks, and contagion fears continue to dominate headlines. Yet again, it was another historic week in the markets as Gold and Silver continued to rise with turmoil in the banking sector and the Fed trying to backstop the market by inflating its balance sheet by $400 Billion in the past two weeks. Their fight against inflation remains on hold while attention shifts to assisting troubled banks, with Deutsche Bank being the most recent. The problem banks are having is the rising cost of insuring against defaults, resulting in increased borrowing costs. Meanwhile, the capital flees into safe-haven vehicles such as the U.S. Dollar, Bitcoin, Treasuries, Gold, and Silver, dramatically reducing the level of deposits.

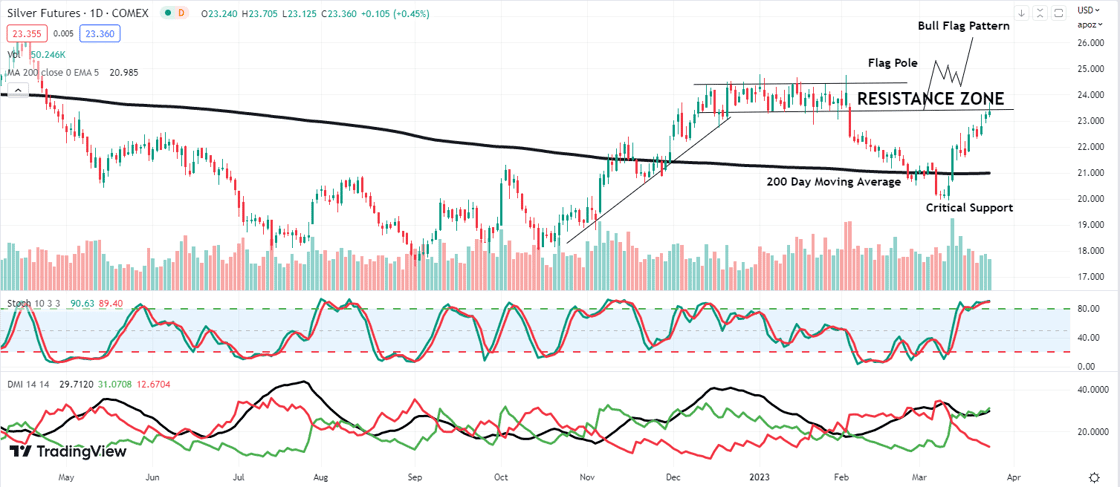

Daily Silver Chart

The technical backdrop shows Silver has continued to achieve new swing highs but is trading into the thick of the February 2 reversal with major three-star resistance at 23.81-23.85. The first level of support is just below the 50 DMA at $22.43 and the 200 DMA at $21.24. We suggest using that level for "stop-loss" protection for clients currently long Silver. Looking at the stochastics, they have pushed into "over-bought" territory indicating that the current bull market is alive and well. The technical chart pattern suggests that Silver is amid a "Bull flag pattern" and could extend back to the $23-$25 consolidation range, as we saw from December through February.

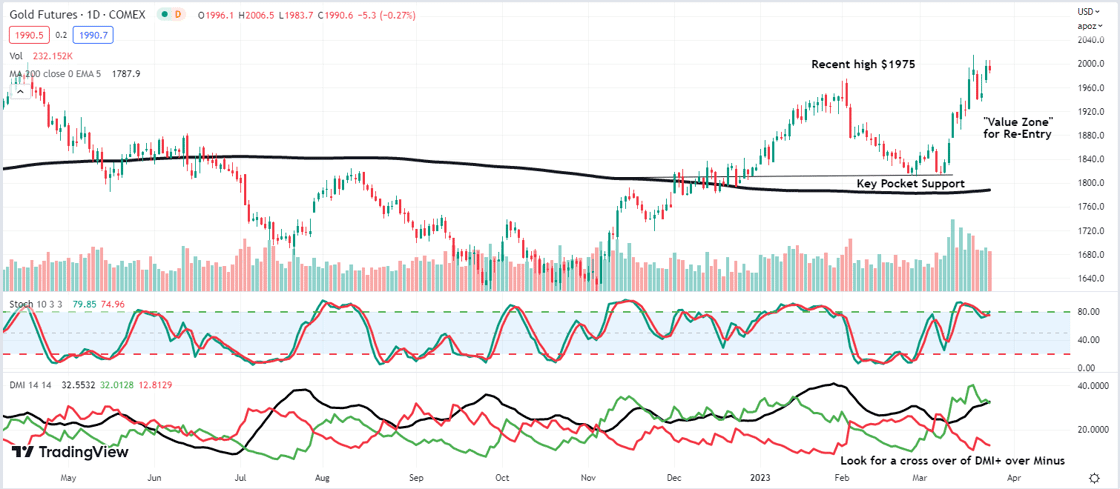

Daily Gold Chart

The technical backdrop in Gold shows a crucial double bottom at $1811/oz, and the market is well above the 200 DMA at $1787/oz. Stochastics are rising into overbought territory, and DMI+ is crossing back over DMI- indicating a healthy mature bull market. A critical level we are watching is the overnight low from the FOMC downward spike to 1982.3, now the first key support. A break below 1967.1-1975.2 will begin signaling a near-term failure. Therefore, we would be only cautiously Bullish and reevaluating upon such a move.

Our Strategy

The near-term macroeconomic backdrop remains on edge, while the long-term outlook should entail a series of rate cuts into the fourth quarter of 2023. We recommend that clients trim exposure in the Gold market as it has risen over $200/oz in two weeks.

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial