Gaining Clarity In The Fog Of War (Silicon Valley Bank's Duration Wipeout) | Top Things to Watch this Week

Posted: March 13, 2023, 8:13 a.m.

Gaining Clarity In The Fog Of War (Silicon Valley Bank's Duration Wipeout)

"At all times, look at the thing itself - the thing behind the appearance." - Marcus Aurelius

Chart Booklet & More

Access this week's chart booklet with a look at Silicon Valley Bank's duration mismatch and last week's Nonfarm Payrolls data. We also cover in-depth corporate trends with Morgan Stanley, United Health, and Adobe. We will provide an updated chart book with more data on corporate trends when we release Triple Play Episode 11!

Triple Play Podcast

Don't miss episode 10 of our Triple Play Podcast! Bill Baruch and Jannis Meindl discuss the latest macro trends and share three actionable stock ideas.

Macro & Financial Conditions

Silicon Valley Bank Failure & The Regulators' Response

The United States Federal Reserve has two congressional mandates: an average inflation target of 2% and full employment. As Jerome Powell has talked about in many instances, without 2% average inflation, all aspects of the economy suffer. Yet on Friday, the Fed's third mandate came into play: financial stability. Financial stability writ large refers to the US financial system on which millions of people rely daily to meet payroll, finance the working capital of corporations, and draw money from credit lines to meet obligations. Absent the banking system's willingness to lend money while assuring depositors their money is safe, nothing else in the economy works. Yes, nothing else.

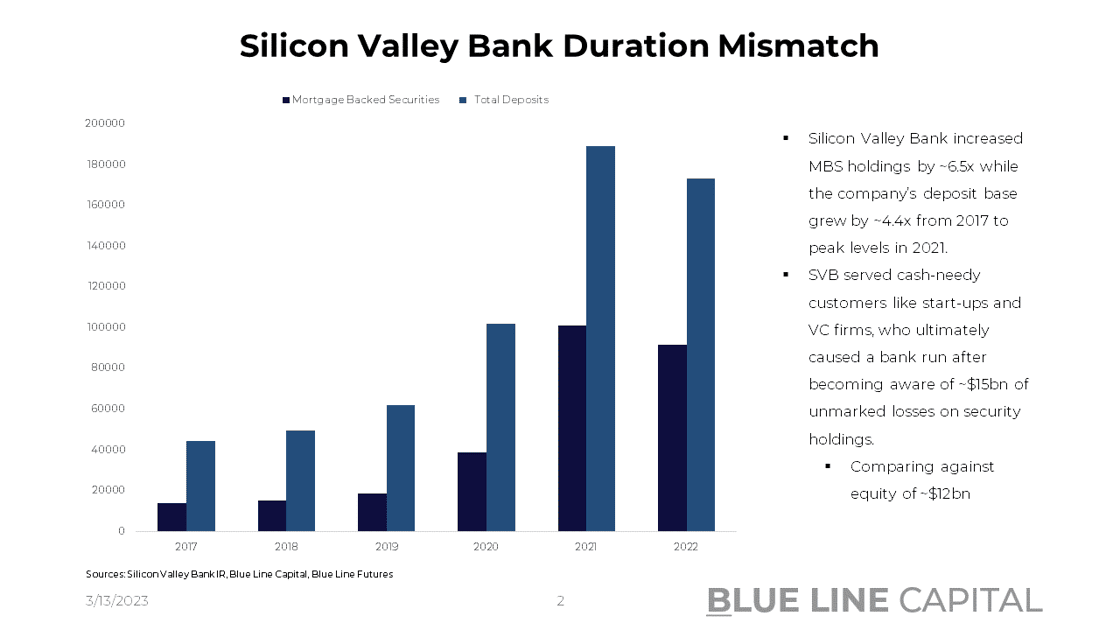

Last week, Silicon Valley Bank raised ~$2bn in equity capital given that its significant unmarked mortgage-backed securities losses it had bought at the bond market peak in 2020 would mean a wipe out of its equity if it had to use those securities to meet deposit outflows. To put some numbers behind the duration mismatch, SVB was banking high cash-burning startups with daily liquidity needs. Still, as the bank's deposits grew from $61bn in Q4 2019 to $189bn in Q4 2021, so did the bank's mortgage-backed securities holdings (~$173bn in Q4 2022; via Raging Capital Ventures on Twitter). As a yield-enhancing strategy, the bank took on massive duration risk, increasing its MBS holdings by 6.5x, buying $88bn of mortgage paper. The company's footnotes disclosed that those same securities holdings had an unmarked loss of ~$15bn if they had to be sold, exceeding the company's equity of ~$12bn before the wipeout unfolded.

Concerns around SVB's liquidity position started a cascade of venture capitalists and start-ups who hit the outbound wire button, causing the bank's liquidity position to worsen to the point where the FDIC had to come in on Friday and put the bank into receivership; receivership means that the regulatory agency started a process of finding buyers for the bank and if it couldn't find a buyer start to pay out bank deposits while initiating sales of existing assets.

Rough estimates concluded that uninsured deposits, of which Silicon Valley had more than 90%, would receive ~70-80 cents on the Dollar, meaning that anyone who left money with the bank would see a 20-30% loss. According to Marc Rubenstein on Twitter, SVB had 37,466 deposit accounts with an average balance of $4.2m (clearly exceeding the FDIC's deposit insurance limitbof $250k.)

As a tech-focused bank serving companies and venture capital firms whose deposits require high agility, the response to the bank's duration mismatch triggered the bank's failure.

Notice that short sellers had already targeted the bank, as the Financial Times reported on Feb. 22, 2023. The Financial Times talked about that very mismatch.

Customer deposits surged from $102bn to $189bn, leaving the bank awash in "excess liquidity". The bank piled much of its customer deposits into long-dated mortgage-backed securities issued by US government agencies, effectively locking away half of its assets for the next decade in safe investments that earn, by today's standards, little income.

Thus, after the bank went into receivership on Friday, all eyes were on the Fed's and the Treasury's next steps. Absent an assurance that all depositors would receive their money back, classic bank runs, as experienced by SVB, were feared across the banking system. First Regional Bank's stock was substantially lower in Friday's trading session, fearing that its lending activities in the private equity arena could lead to a similar run. Perhaps even more significantly, Charles Schwab, with more than $7 trillion in customer deposits, became another target for a potential duration mismatch. Having seen a decrease in Schwab's available-for-sale securities from $390bn in Q4 2022 to $147 in Q4 2022 while held-to-maturity securities increased from $105.3bn (Q1 2022) to $173.1bn (Q4 2022), the stock traded below $60 on Friday.

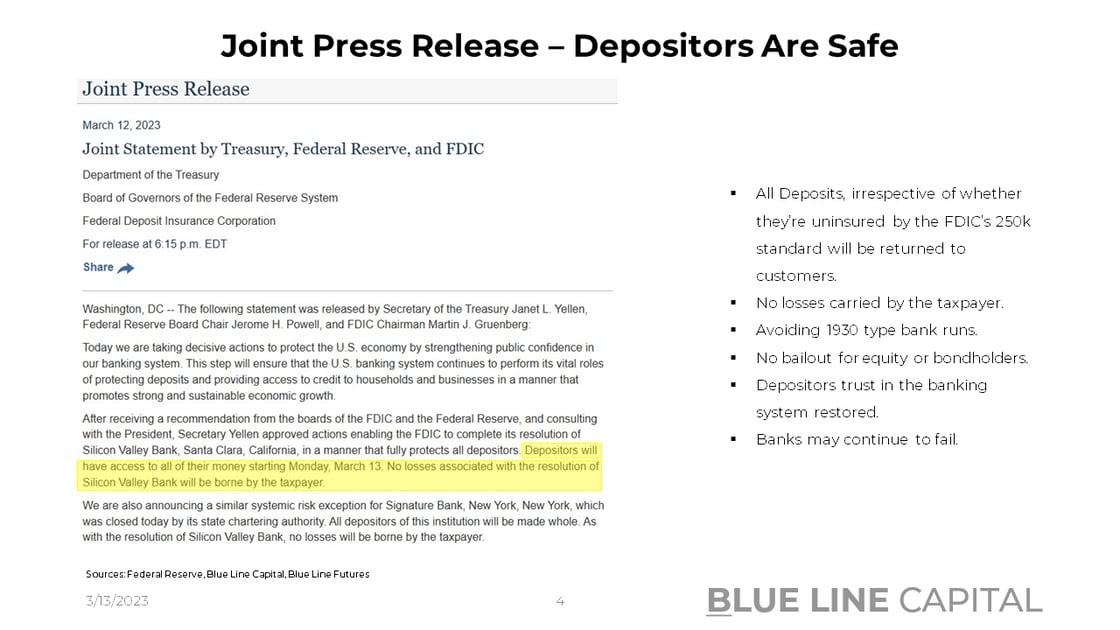

The implications of what happened to SVB caused regulators to step in decisively Sunday night:

After receiving a recommendation from the board of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors. Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.

In an additional step to address existing funding concerns, the Fed also announced a liquidity provision facility by creating a new Bank Term Funding Program (BTFP). In the term sheet of the liquidity facility, the Fed states that the collateral used will be valued at par.

As a result, uninsured depositors don't have to worry about their bank's liquidity position even if the duration mismatch persists.

To quote Nick Timiarios' Tweet in response to the Fed's actions:

Dan Taruollo: "We learned today that a $200bn bank was too big to fail - or at least too big to be allowed to fail with losses borne by large depositors, as the bank resolution system assumes.

Despite the Fed's response with a $25bn Treasury backstop of the BTFP facility, Frist Republic Bank is down 63% pre-market after Signature Bank was put into receivership Sunday night. Jim Chanos tweeted in response to the regulators' actions:

I'd just like point out that none of these policies address the fundamental duration mismatch...the inability so far for the FDIC to find a buyer for the SIVB deposit base (or the bank to find investors last week), should be a warning sign for equity values.

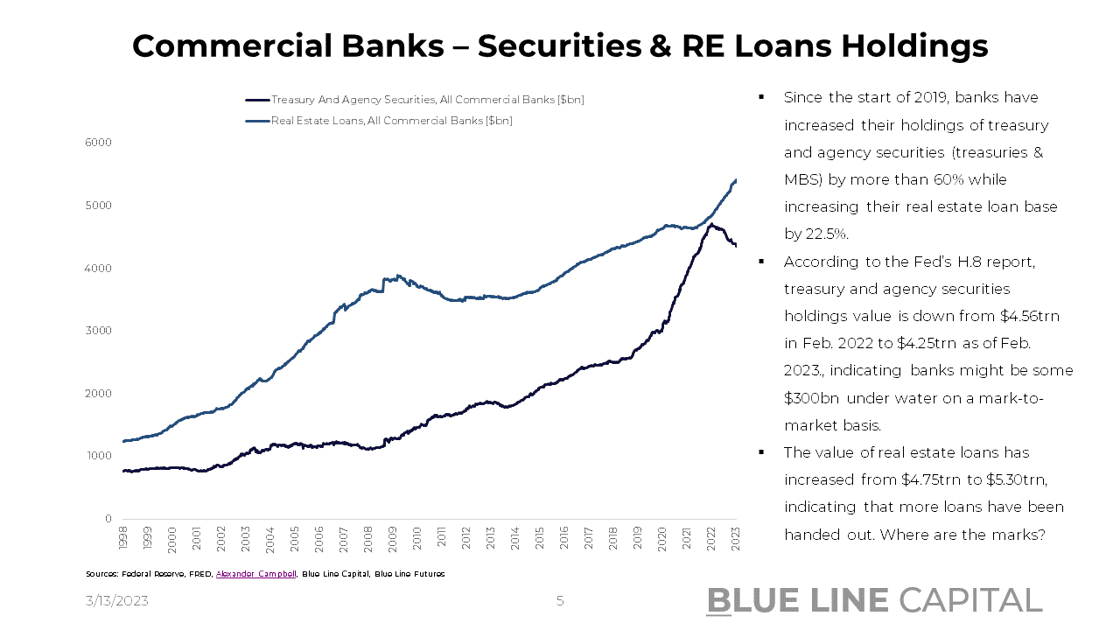

Thus, if banks aren't hedging their interest rate exposure with interest rate swaps, then US commercial banks appear to hold ~$4.25trn in treasury and agency securities ($2.72trn of which are MBS), down from $4.56trn. The mismatch between depositors' needs and the banks' holdings is cause for concern as long as today's fears persist.

In a flight to safety, the 2-year treasury yield is trading below 4% this morning after setting new local highs above 5%.

Take advantage of last week's Triple Play Podcast, where Bill Baruch and Jannis Meindl cover the latest macro and corporate trends.

Nonfarm Payrolls Review

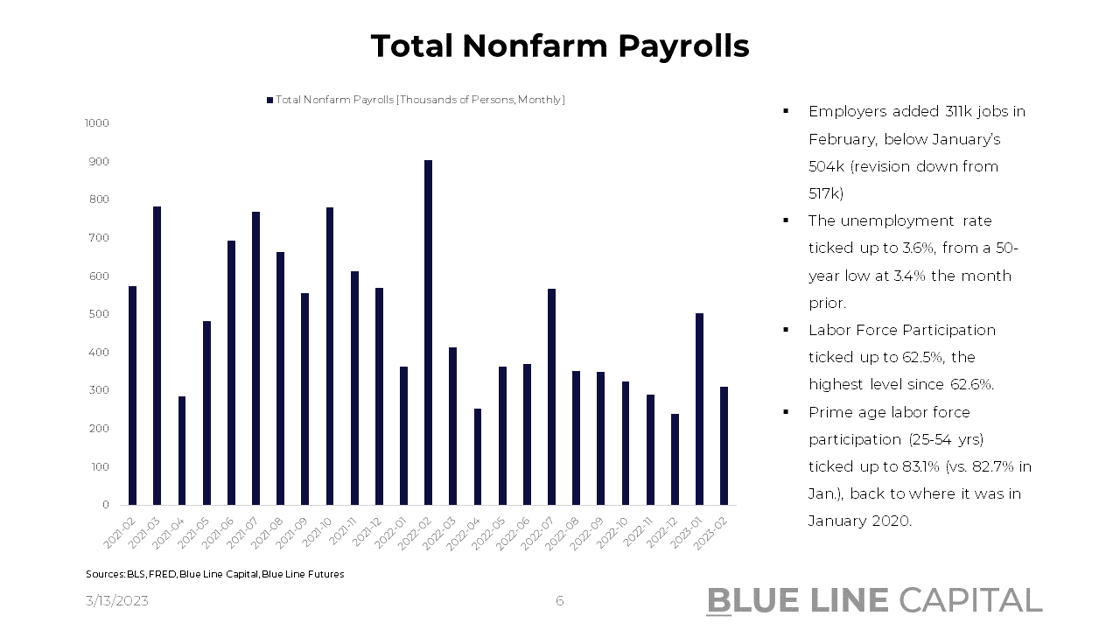

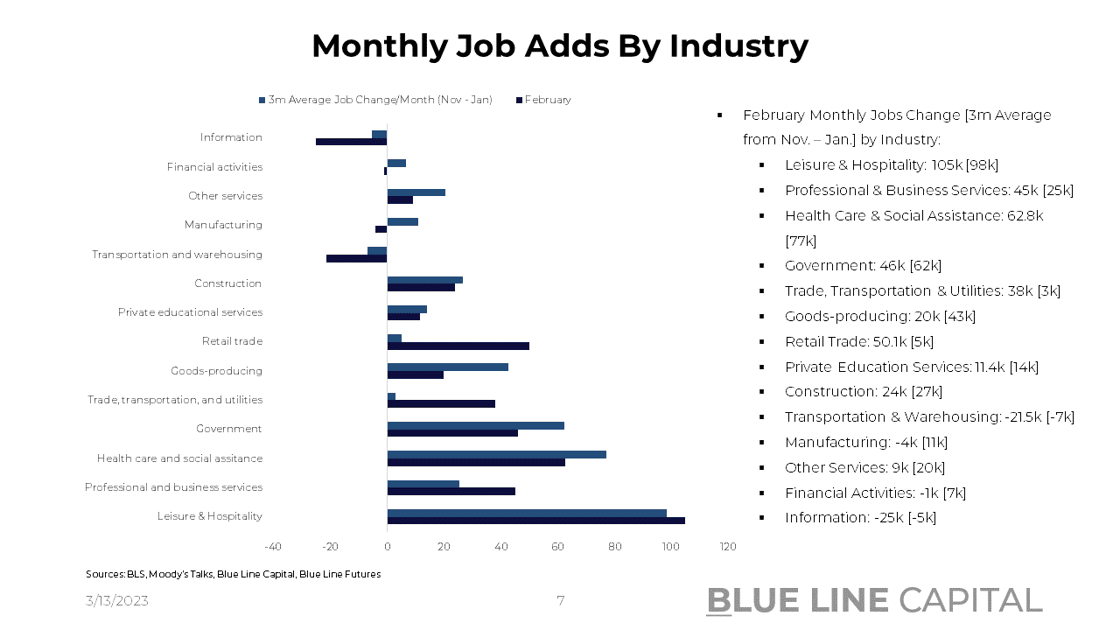

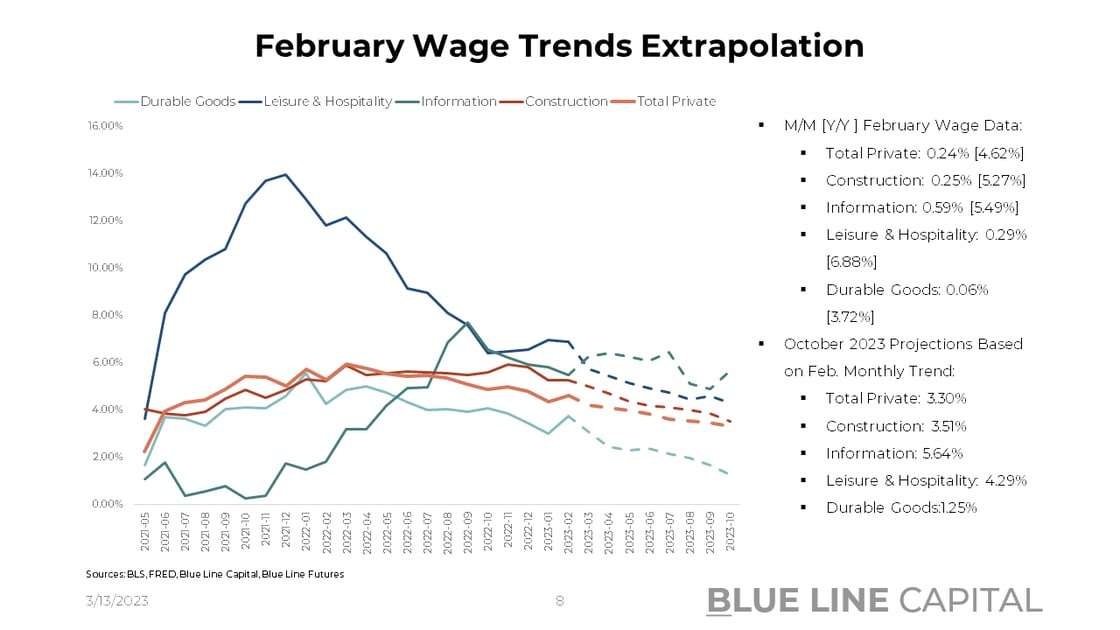

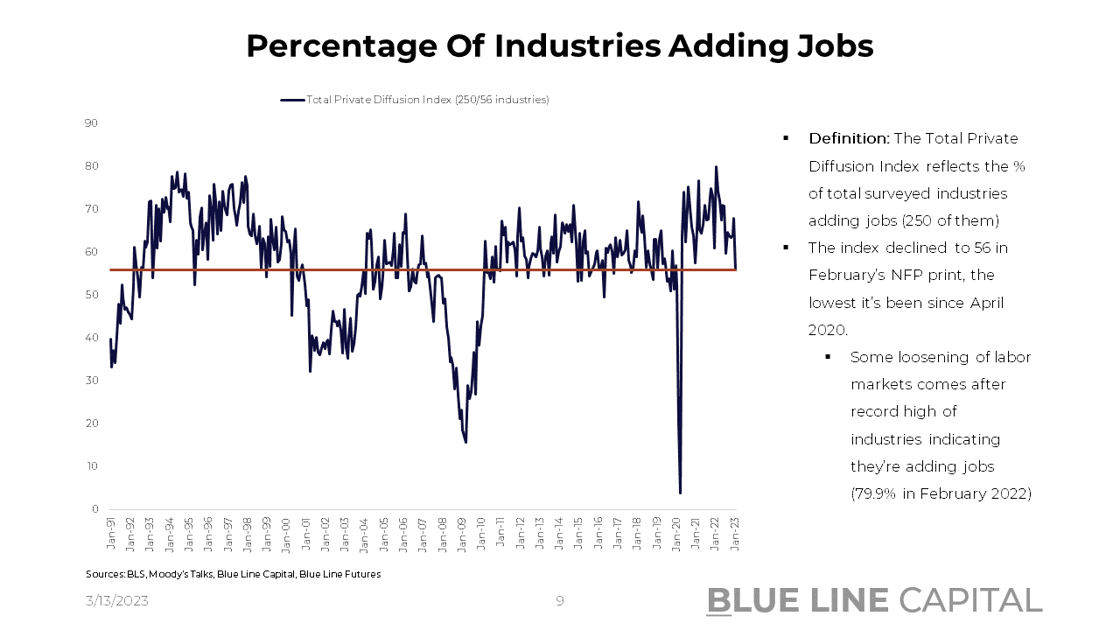

After adding 504k jobs in January (revised down from 517k), the BLS reported 311k jobs added in February, another hot print. Nevertheless, M/M wage increased at 0.24%, indicating an annualized rate of ~2.9%. The most significant job adds were in lower-wage industries, including leisure & hospitality, at 105k job additions, indicating that the data might be slightly skewed to the downside. Using February's monthly wage trends to extrapolate wage trends into the future, the same monthly rate increase would get us to 3.30% Y/Y of total private by October.

Please find more information in our chart pack. All the weekly data releases will be covered in our daily Morning Express, authored by Bill Baruch.

Don't miss Episode 10 of our Triple Play Podcast -- Bill Baruch and Jannis Meindl share their thoughts on Schlumberger, Palo Alto Networks, and Uber.

Chart-Pack Macro Slides

Stay tuned for Episode 11 of Triple Play!

Until next time, good luck & good trading.

Be sure to check out prior writing of Top Things to Watch this Week:

- 2023, A Macro Safari En-Route 2019 - Mar. 5, 2023

- The Fed's Preferred Inflation Indicator & Energy Markets - Feb. 27, 2023

- Making Sense of Inflation & Spending Data - Feb. 19, 2023

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

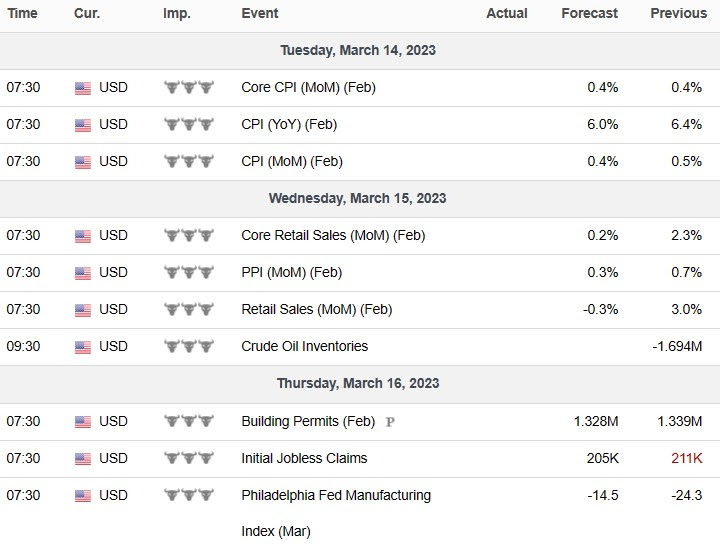

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

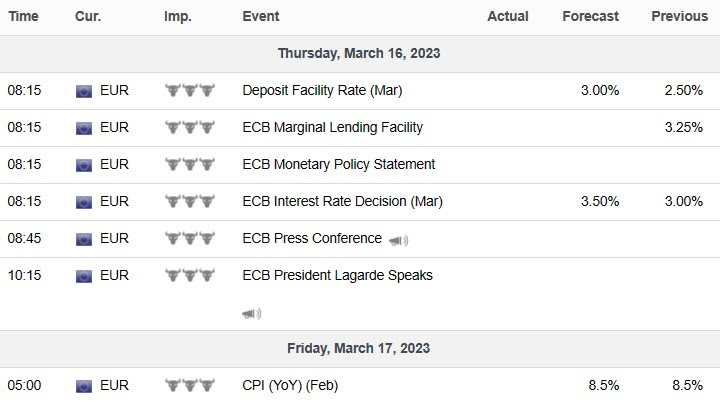

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial