Gold/Silver: The Safe-Haven Buying begins

Posted: March 10, 2023, 10:12 a.m.

|

It was a roller coaster ride of a week not only in Precious Metals but across asset classes with what seemingly has been one extreme volatility event after another. Over the past week, Jerome Powell reiterated the Fed's hawkishness, driving 2-year Treasury Yields to their highest since 2007, and the Yield Curve (2's vs. 10's) inverted the most since 1981. The terminal rate (the final interest rate hike level) rose 25 bps. to 5.65%, shocking the market and leaving the chances of a 50 bps rate hike at the March 22 meeting at 60%. The move in the terminal rate sent Gold diving $35/oz and Silver over $1.00, pushing the May contract below $20/oz!

Gold found support along with U.S. Treasuries, with the fall out of the Silicon Valley Bank and the demise of Silvergate, triggering speculation that credit event risk is rising. Looking forward, we can expect calls from regulators to stress-test banks and questions asking if there is a more significant contagion risk or if it is contained. Will money flow into safe-haven assets such as Gold, Silver, Treasuries, and flee risk assets? Early indications say yes, and that is why it is essential to own a long-term position that is highly liquid with nearly 23 hours/day of market access, such as futures contracts.

Daily Silver Chart |

|

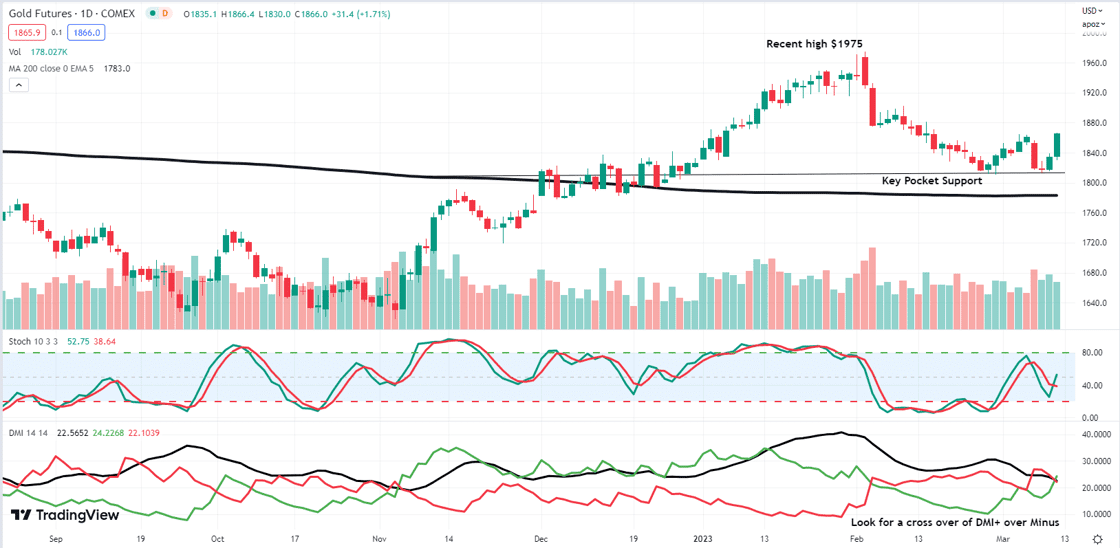

Daily Gold Chart |

|

The technical backdrop in Gold shows a crucial double bottom at $1811/oz, and the market is well above the 200 DMA at $1785/oz. Stochastics are rising, and DMI+ is crossing back over DMI-. If the April Gold contract can close above $1865/oz, it should ignite the bulls and rally back to 1900. A close over 1910 should spark another wave of buying up to 1950-2000 with panic buying.

Our Strategy

The near-term and long-term macroeconomic calendars have event-driven risks with U.S. Feb CPI on Tuesday, U.S. Feb PPI on Wednesday, U.S. Empire Manufacturing data, and Retail Sales. We have the ECB Meeting on Thursday, and on March 22, we have the next FOMC meeting.

We see value in systematically purchasing regular intervals of the 10-ounce Gold contract or 1000-ounce Silver contract. You can layer in over time and preposition for the next rally. One example with a $25,000 account size would be to focus on the December 2023 10-ounce Gold contract and use a dollar-cost average approach by purchasing 10 ounces of Gold at 1850/oz, 10 oz at 1800, and 10 oz at 1750 with a year-end target of $2100/oz.

If filled on all three contracts, your average price will be $1800/oz; therefore, every dollar move Gold makes on the three contracts will be $30 since you control 30 ounces. If the $2100/oz price objective is achieved by year-end, this will result in a gain of approximately $9,000 (30 oz times $300 rise). Traders should also consider proper risk management using a dollar-cost averaging approach, such as a hard stop on three contracts at $1700. If that were to occur under this scenario, it would likely result in a loss of $3,000. |

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial