.jpg)

2023, A Macro Safari En-Route 2019 | Top Things to Watch this Week

Posted: March 5, 2023, 1:34 p.m.

"Doubt is not a pleasant condition, but certainty is absurd." - Voltaire

Chart Booklet & More

Access this week's chart booklet with data on credit spreads, private markets, and China. We also cover in-depth corporate trends with Schlumberger, Palo Alto Networks, and Uber. We will provide an updated chart book with more data on corporate trends when we release Triple Play Episode 10!

Bill Baruch joined CNBC's Halftime Report to talk about Salesforce ahead of earnings.

Triple Play Podcast

Don't miss episode 9 of our Triple Play Podcast! Bill Baruch and Jannis Meindl talk about the latest macro trends and share three actionable stock ideas.

Macro Dynamics

Risk Remains With Risk-Free Rates

The macro picture remains murky as inflation hiccups from CPI to PCE painted a concerning picture after 2022 closed on a positive note about the prospects for a soft landing. Nevertheless, equities are seeing through the reemergence of inflation (at least for the time being), indicating that there is line of sight to a 2019-type economic environment; perhaps, with structurally higher wages, but a Chinese economy that buys fewer commodities while it keeps supplying goods to the West, the world may end up in a spot that's not too dissimilar to what was pre-Covid.

One profound difference between now and then is a 2-year yield near 5%. While it might seem like an easy escape from inaction in a stock picker's market, consensus views don't generate above-average returns by their very definition. The risk? Equities rally, and the opportunity cost of holding treasury paper rises, creating FOMO.

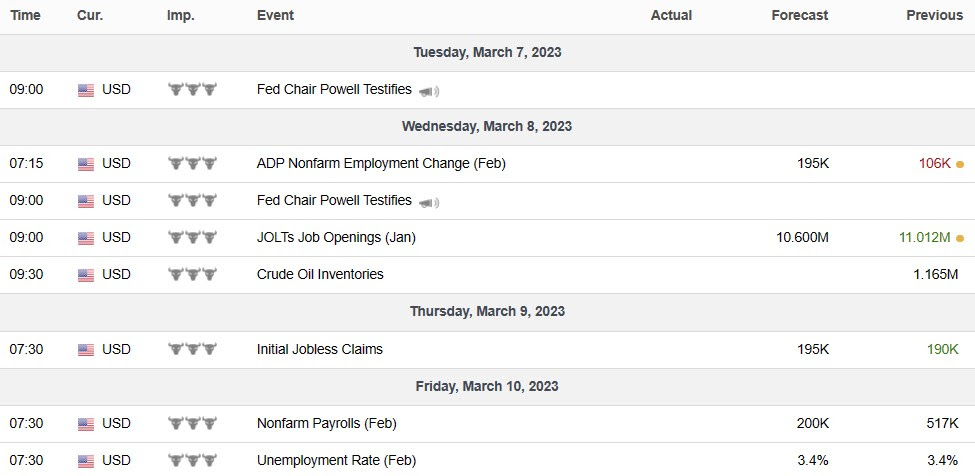

Thus, while initial claims at +190k indicate continued tightness on the labor side, revised nonfarm productivity at +1.7% points to limited growth (vs. 2.5% forecast), and revised unit labor cost at 3.2% suggests significant wage pressures (vs. 1.6% forecast), let's reflect on real economic dynamics ahead of Nonfarm Payrolls next week.

To set the stage, let's recall that Nonfarm Payrolls came in tremendously hot at +517k jobs added in February, attributable to gains in services and retail, while areas like manufacturing and IT were much weaker. With Jay Powell set to speak in front of Congress on Tuesday and Wednesday, markets will also pay attention to any revisions of the Fed's rhetoric in response to recent data releases. Putting things into perspective, let's tackle some giant elephants on the macro safari.

When markets diverge from reported data, one of two scenarios may be true; either the market is blind to the realities on the ground, or we are dealing with data fog. We only have to look back as far as January 2020, when Covid began to be a thing in regions like China, yet markets decided to dismiss the evidence. Only with a massive lag and a realization of the implications of the disease did investors react by selling risky assets like a pendulum that swings from flawless to hopeless. The other possibility is that the underlying data is distorted, giving us wrong inferences. If we compare January's CPI at 6.4% Y/Y to data collected by Truflation showing 4.85% Y/Y, one has to wonder which of the two numbers reflects reality. Regarding Truflation's subcomponents, food, which CPI tells us is still hovering at 10.4% Y/Y is down to 2.93% Y/Y. While I won't take this assessment and turn it into what the market may or may not come around, you can draw your conclusions.

ISM manufacturing data disappointed at 47.3 compared to expectations of 47.8 on Wednesday. More significantly, manufacturing prices turned positive at 51.3 compared to expectations of 45.5. While manufacturing was not according to plan, Services PMIs on Friday painted a much more encouraging picture. Services PMIs were reported at 55.1, proving a relatively solid consumer while prices decelerated to 65.6. Again, confirmation that an okay economy with decelerating prices can bode well for risky assets.

Take advantage of last week's Triple Play Podcast, where Bill Baruch and Jannis Meindl cover the latest macro and corporate trends.

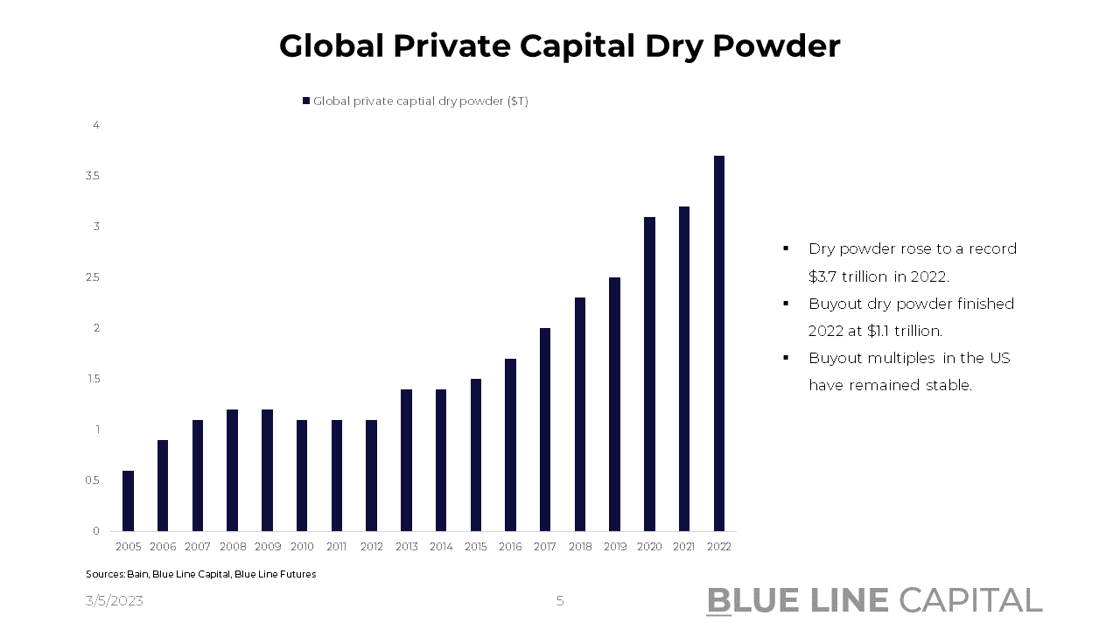

From Private Buyouts To China

Outside of macro data, we can think about the world as a set of choices. Either you put your money in stocks or bonds. The attractiveness of the two asset classes depends on the expected yield they offer relative to one another, which brings us right to the present day. Compared to Fed Funds, investment grade debt one grade above junk only earns 1.33% excess return with investment Aaa a mere 26bps above Fed Funds. While alarm bells should go off when we compare risky to riskless assets at such compressed spreads, duration is a multifaceted issue. For one, earning 4-5% for the next 5-10 years differs from earning 4.5% for the next 2. Moreover, in contrast to equities that offer the residual claim on cash flows after debt payments have been performed, the short-term paper only offers limited upside if economic conditions improve. Thus, if we want to entertain a 2019 regime today, the rewards will be harvested by equity investors and holders of duration.

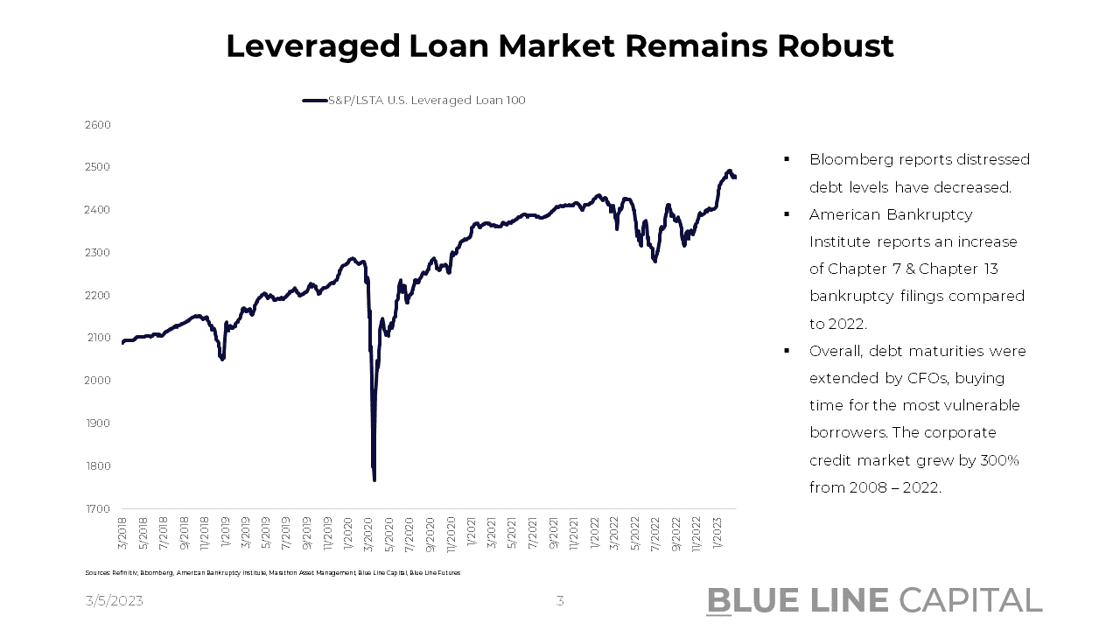

The evidence that a relatively robust corporate regime may exist in the face of an inflation slowdown is ample, from companies in luxury to semiconductor stocks that may be sniffing out a cyclical bottom after estimates were slashed. Thus, the economy's overall health is okay despite a shift from discretionary to non-discretionary items as auto, credit card, and mortgage loan delinquencies increase. To shamelessly steal some statistics from Moody's Talks, let's put some color on the extent of consumer borrowing and what it means for the macro picture in aggregate. According to Moody's Analytics chief economist Mark Zandi, consumers have $800bn credit card debt, $200bn consumer finance, $1.5trillion auto, $1.5 trillion in student loan debt, and $12 trillion in mortgage debt. While the first two receive many drumrolls, the aggregate spending mix shift is far less responsive to these two factors. On the side of Corporate America, Bloomberg reports that distressed debt levels have dropped despite an increase of Chapter 7 filings from 15,177 in 2022 to 16,606 in January 2023. Stress is more concentrated in fields like office real estate, while single-family home delinquency rates are kept extraordinarily low. As long as the upper percentiles of the consumer remain in healthy shape while the lower end of the income spectrum can mitigate defaults to an extent, recession talk can retrace.

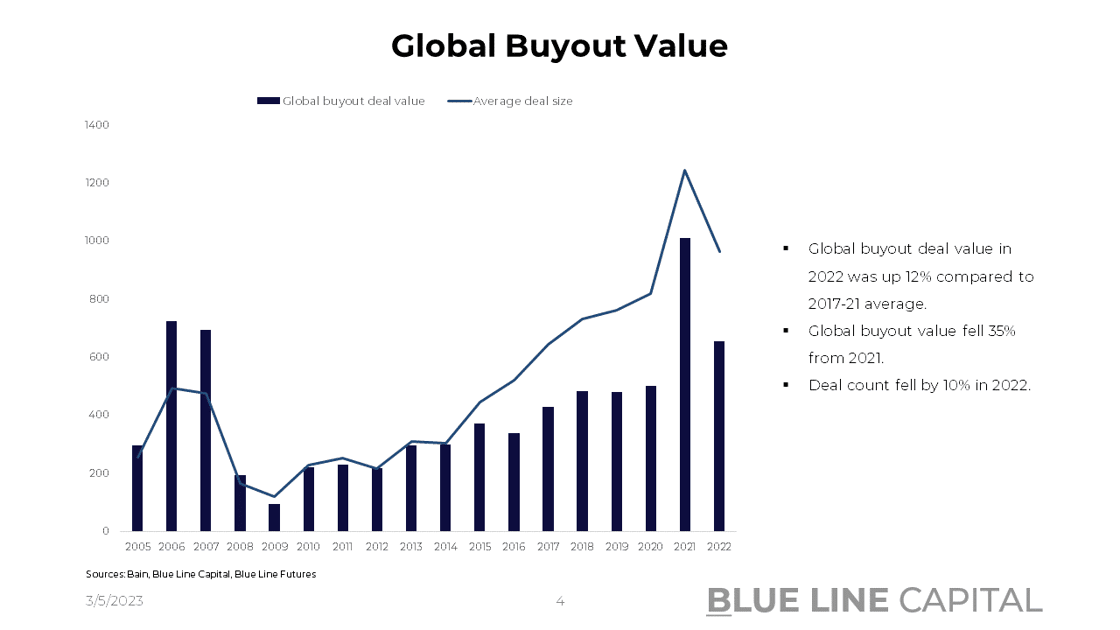

According to Bain, global buyout deal activity was off significantly from 2021 levels in 2022 but above 2019. With a total of $654bn of global buyouts in 2022, we compare unfavorably against $1,012bn in 2021 but rather positively compared to $501 in 2019 and $480bn in 2018. FactSet is reporting similar dynamics on the M&A side.

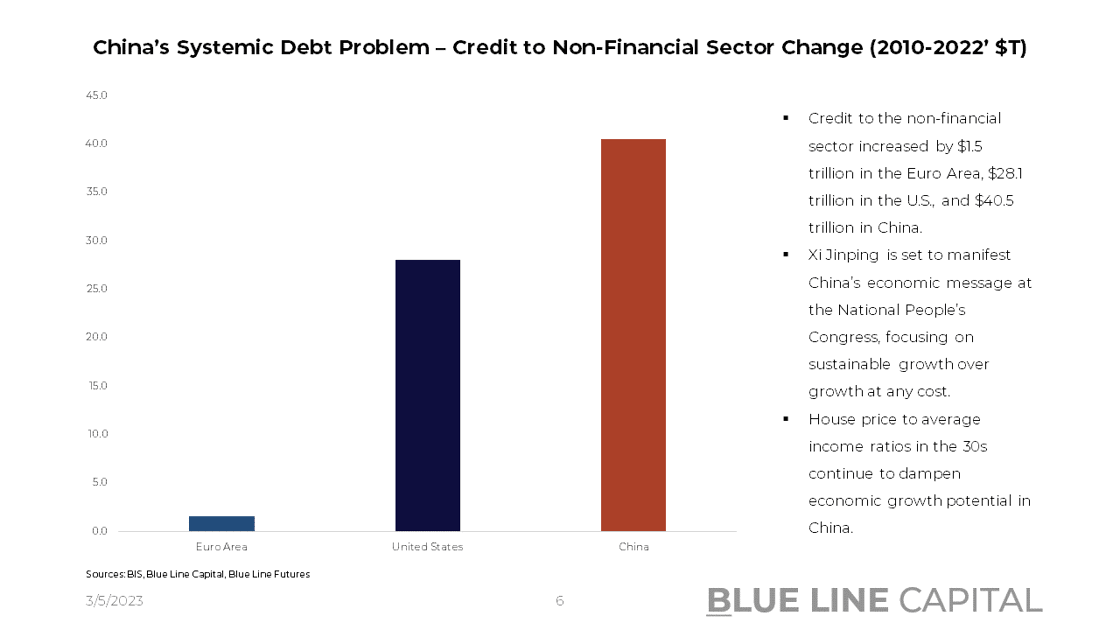

Beyond deals and buyouts, we focus on China and its role in the Global Power Competition against the U.S. and its allies. The vast majority has eagerly awaited China's reopening and whether ultra-restrictive lockdowns can result in pent-up spending. In contrast to prior cycles in China, the CCP has clearly outlined its goals: sustained growth over growth at any cost. Accordingly, as the consumer reemerges, questions start to surface about whether fiscal stimulus is necessary to support the consumer. Thus, as officials hesitate to make transfer payments, home equity may decline, indicating consumers will hang back on spending all their deposits. Amplifying skepticism about the degree the CCP will stimulate, Xi Jinping kicks off the National People's Congress in Beijing this Sunday. Among Xi's new team are Li Qiang, a loyalist who oversaw Shanghai's lockdowns, and four other proteges that will be instrumental in setting the country's economic agenda. As a recently published paper by Nicholas Borst titled China's Balance Sheet Challenge writes: "China is now much more indebted than countries at similar levels of economic development. Policymakers should embrace the debt challenge as an impetus to reform China's fiscal system and adjust the role of government in the economy..."

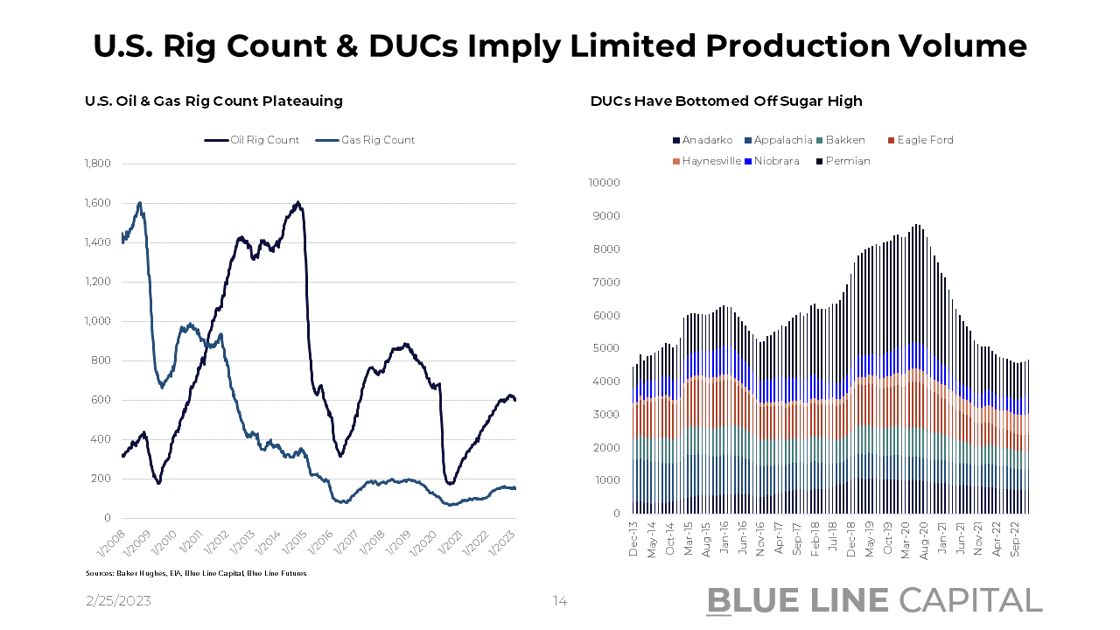

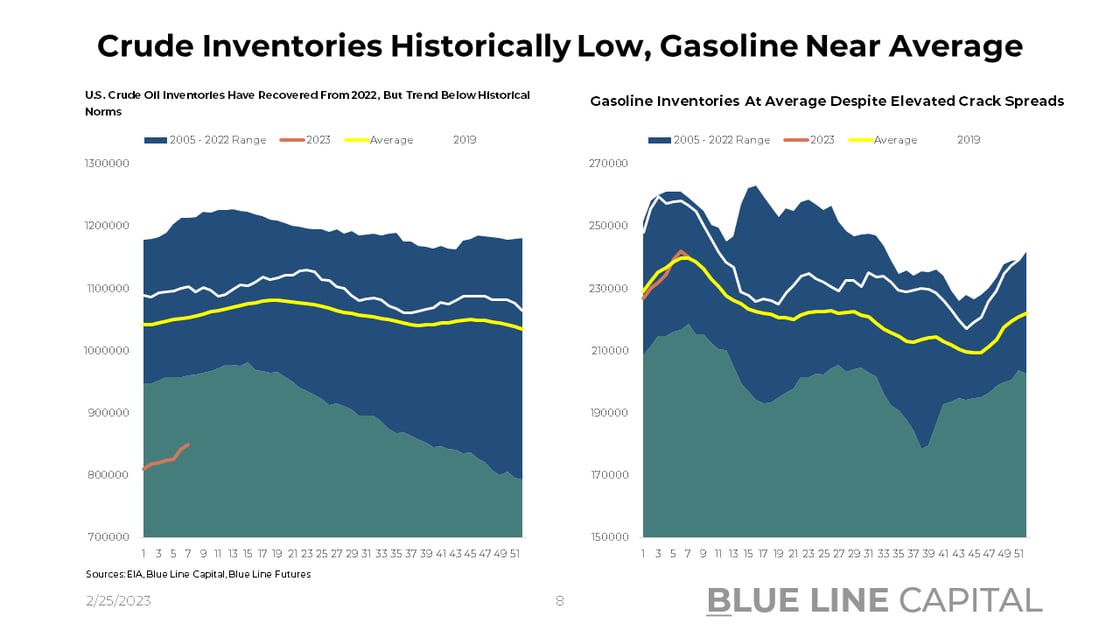

This week's chart pack's macro-section will help illustrate the rather data-light written macro safari.

Don't miss Episode 9 of our Triple Play Podcast -- Bill Baruch and Jannis Meindl share their thoughts on John Deere, Raytheon, and Marvell Technology.

Chart-Pack Macro Slides

Stay tuned for Episode 10 of Triple Play!

Until next time, good luck & good trading.

Be sure to check out prior writing of Top Things to Watch this Week:

- The Fed's Preferred Inflation Indicator & Energy Markets - Feb. 27, 2023

- Making Sense of Inflation & Spending Data - Feb. 19, 2023

- Cognitive Dissonance Pre-CPI - Feb. 12, 2023

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

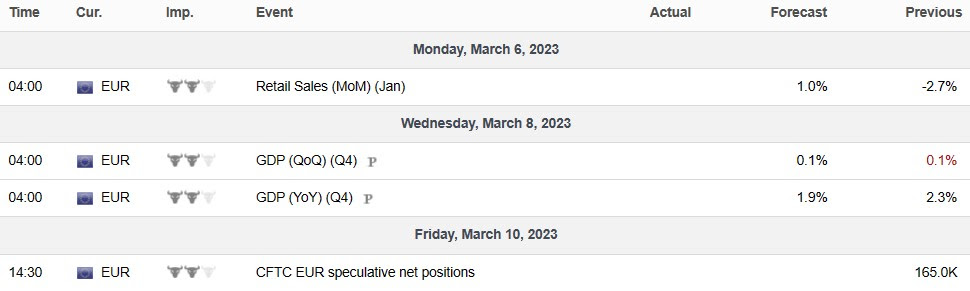

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial