Making Sense of Inflation & Spending Data | Top Things to Watch this Week

Posted: Feb. 19, 2023, 2:26 p.m.

Making Sense of Inflation & Spending Data

"You make most of your money in a bear market, you just don't realize it at the time." - Shelby Cullom Davis (h/t William Green on Twitter)

Chart Booklet & More

Access this week's chart booklet leading with all the key macro data points, including CPI, Retail Sales and PPI. We also cover in-depth corporate trends with AT&T, Lowe's, and AMD. We will provide an updated chart-book with more data on corporate trends when we release Triple Play Episode 8!

Bill Baruch joined CNBC's Halftime Report on Friday, talking about the rotation from high to low multiple consumer staples.

Triple Play Podcast

Don't miss episode 7 of our Triple Play Podcast! Bill Baruch and Jannis Meindl talk about the latest macro trends and share 3 actionable stock ideas.

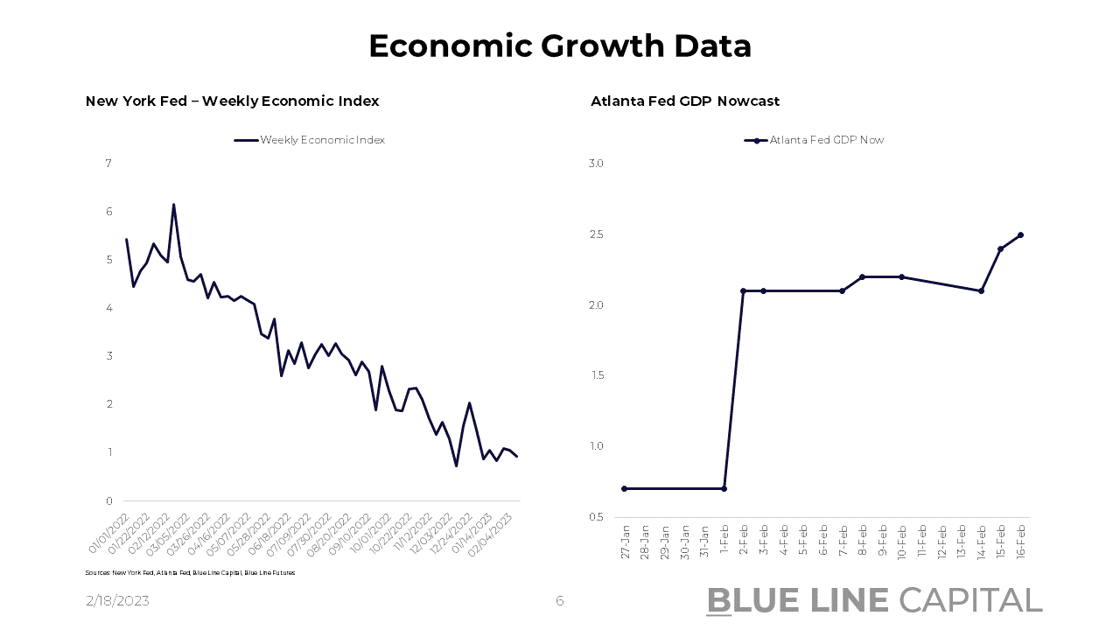

Macro Dynamics

CPI, Retail Sales and PPI

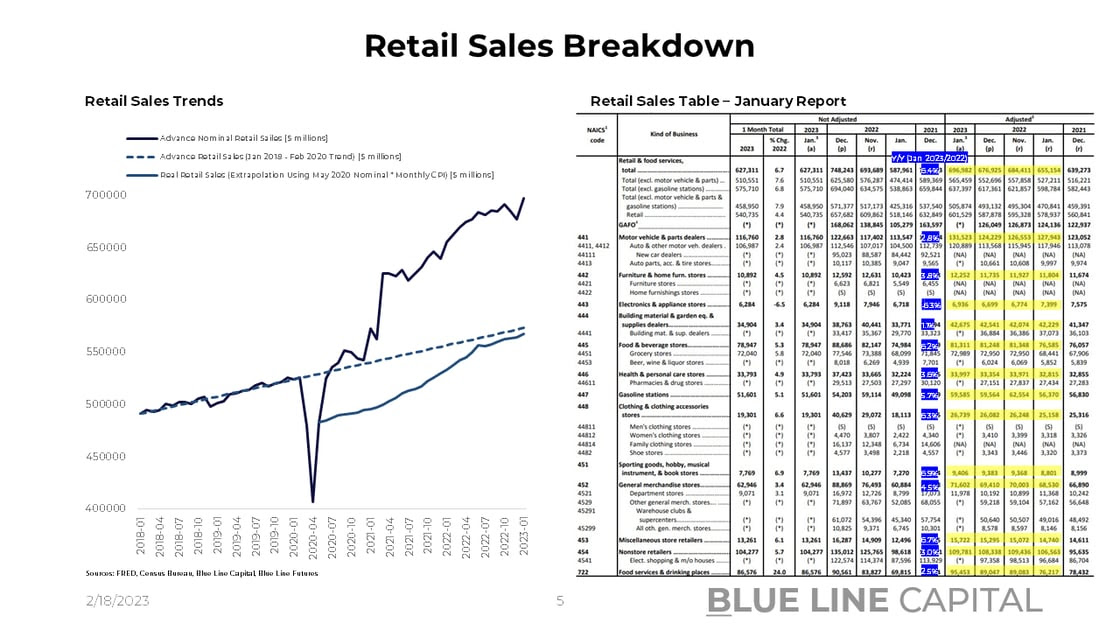

At 0.5% M/M and 6.4% Y/Y, CPI was undoubtedly on the hot side. And while core-CPI at 0.4% M/M was in line with the forecast, PPI on Thursday at 0.5% M/M (vs. 0.3% exp.) was the one-two punch equities weren't fond of. In addition to hotter-than-expected inflation data, Retail Sales came in blazing hot at 3% M/M on Wednesday. With retail sales indicating that the consumer is on a spending spree, keeping pace with nominal price increases, the Fed may have to pull more levers to combat the re-emergence of inflation.

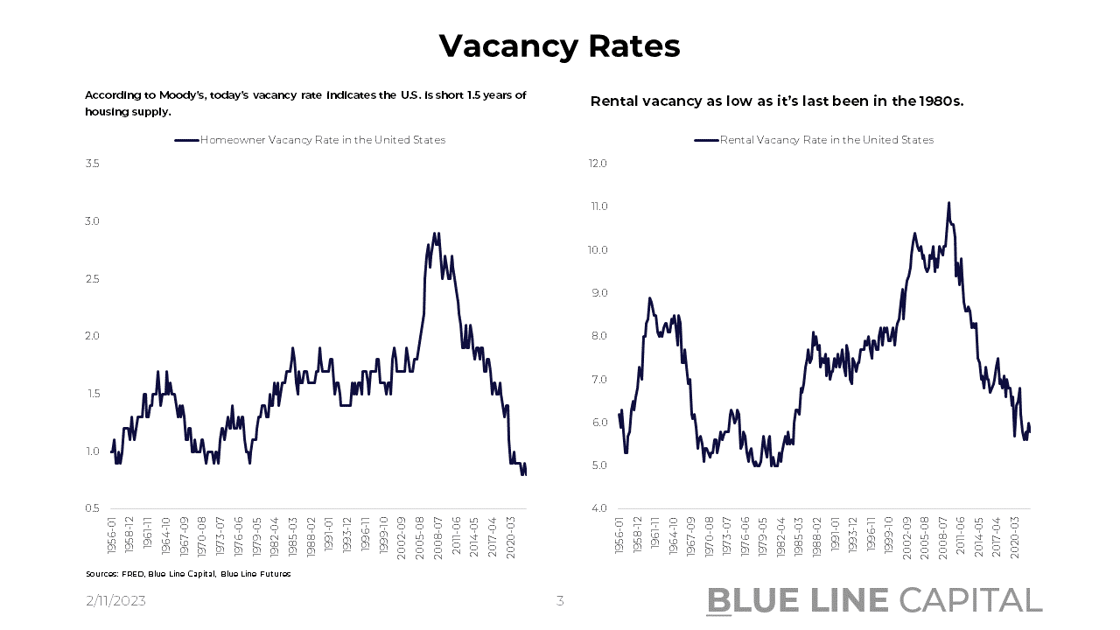

On the back of this week's inflation data, non-voting members Jim Bullard and Loretta Mester voiced their support for a 50bps hike at this past Fed meeting, indicating that hiking 25bps was a missed opportunity. Contrary to Mester and Bullard, non-voting member Barkin erred on the side of caution, echoing what many have suspected coming off of a tremendously volatile Covid-period -- the data is simply too volatile to reach firm conclusions. While the market is unsure which of the two camps will come out on top, employees are incrementally seeing more real wage gains, which should underpin spending. Moreover, structural forces in the economy, namely consumers who've locked in low 30-yr fixed mortgage rates, should underpin consumer spending while keeping delinquency rates relatively low. Consumer spending appetite is also evident when we turn to the latest uptick of the Manheim Used Car Index. The index increased by 4.1% in January, indicating that relatively low domestic auto inventories drive consumers to older cars. Given that inflation is a behavioral phenomenon, wages and prices might be sticky, especially as consumers can "afford" to spend while unemployment stays low and interest payments on mortgages remain suppressed.

Unlike consumers, who are adjusting to new realities (higher inflation), the Congressional Budget Office, which published its budget outlook, assumes that PCE will return to 2% average inflation, meaning that interest payments on US debt are "well contained." As the budget deficit balloons and the US has to roll its debt obligations, it will be interesting to see the fiscal response to higher rates. Surprisingly, Gold has not responded despite breakeven rates having rallied off local lows (a measure of market-based inflation).

Up to date on the latest in macro, let's get into the granularities of the latest data releases (the focus of the chart-packs macro slides.)

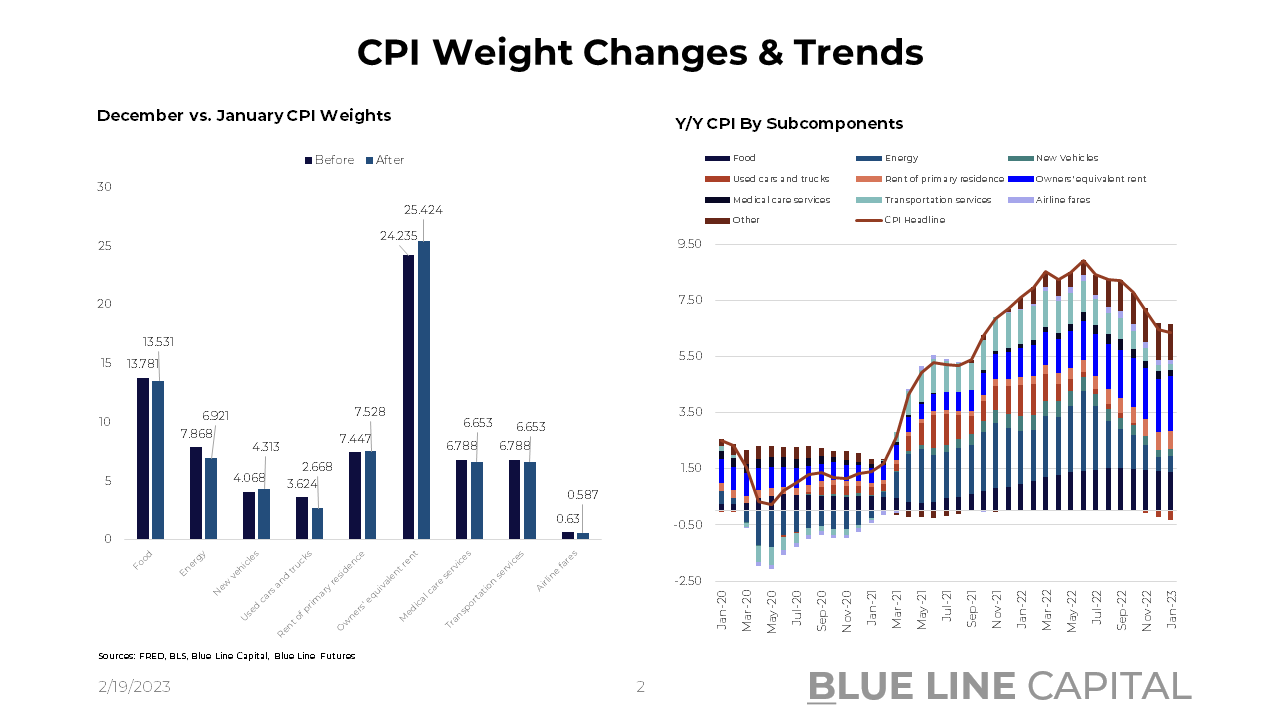

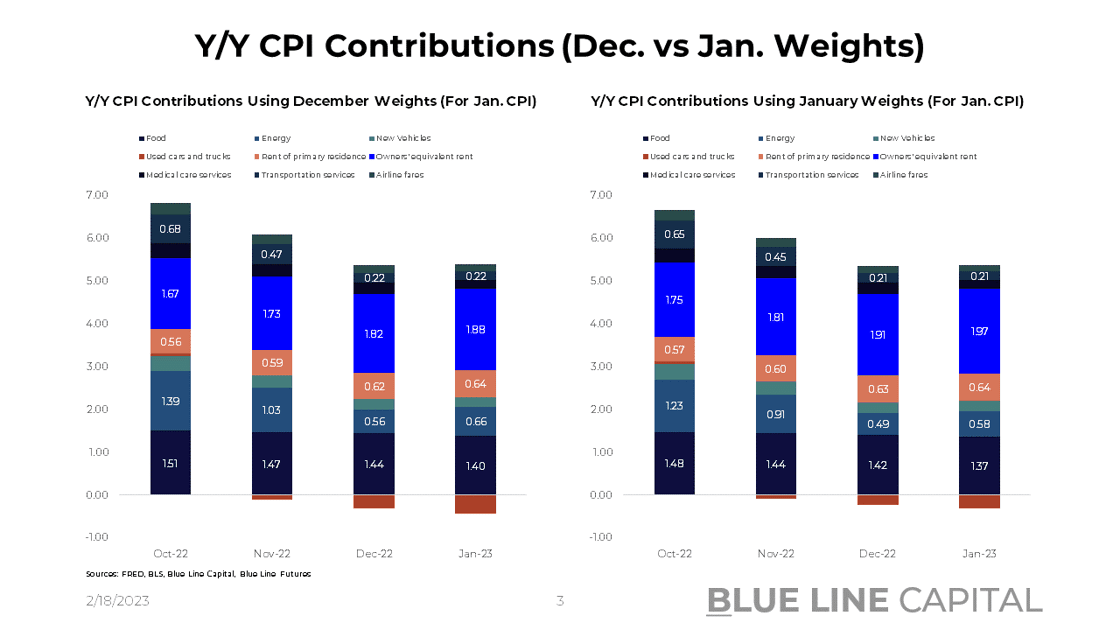

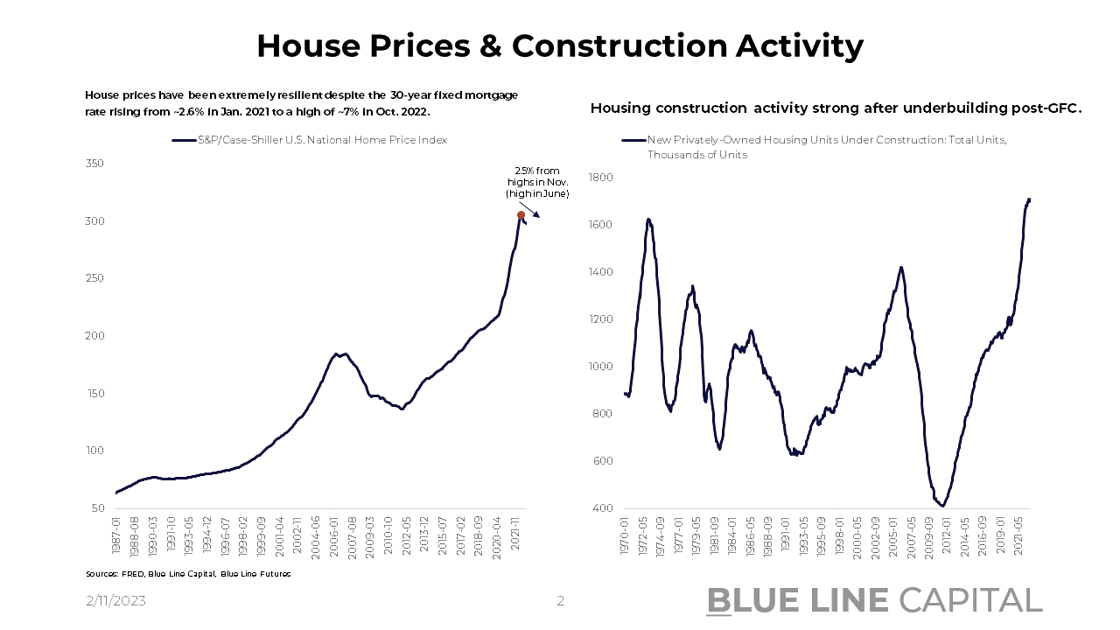

1.) First and foremost, the Bureau of Labor Statistics changed CPI weights, meaning that price changes in the economy will reflect somewhat differently. Changes in energy prices will only contribute 6.9% instead of the prior 7.9%. Used car prices will also reflect less, down from 3.6% to 2.7%. Conversely, rents and house prices for which the Fed expects a rollover of inflation are weighed more heavily; owners' equivalent rent, a measure of what homeowners would charge to rent out their homes, will account for 25.4% instead of the prior 24.2%. Simultaneously, rents will account for 7.5% instead of the prior 7.4%.

All in all, the most notable change is the contribution of shelter to headline CPI, which was 10bps higher in January's print using the new compared to the old weights. That also means the Fed will receive the benefit of house prices and rents, which are expected to contribute much less on a go-forward basis given that the contribution is 1.) lagged and 2.) reflects rent renewals, which happen on a rolling basis. To learn more about all the weight changes, check out slide 2 of the chart pack's macro section.

On a yearly comparison, food decreased slightly to 10.1% from 10.5% in December. However, energy reaccelerated from 7.1% in December to 8.4% in January. New vehicles and used cars both decelerated further while shelter's contribution increased for the 21st month. Surprisingly, a supposed shortage of nurses has not translated into medical care services; on a yearly basis, medical care services ticked down from 4% in December to 3.1% in January.

Transportation services further declined from 3.7% in December to 3.6% in January, while airfares also declined from 29.1% to 25.6% over the same period.

2.) As mentioned, retail sales came in very strong at 3% M/M, reflecting a consumer that keeps spending despite higher prices. Stunningly, though, nominal spending levels adjusted for inflation are only back to 2019 trend, indicating that consumers are getting much less for their money. Looking at sub-categories, clothing and sporting goods were among the strongest numbers, up 6.3% and 6.9% yearly, respectively.

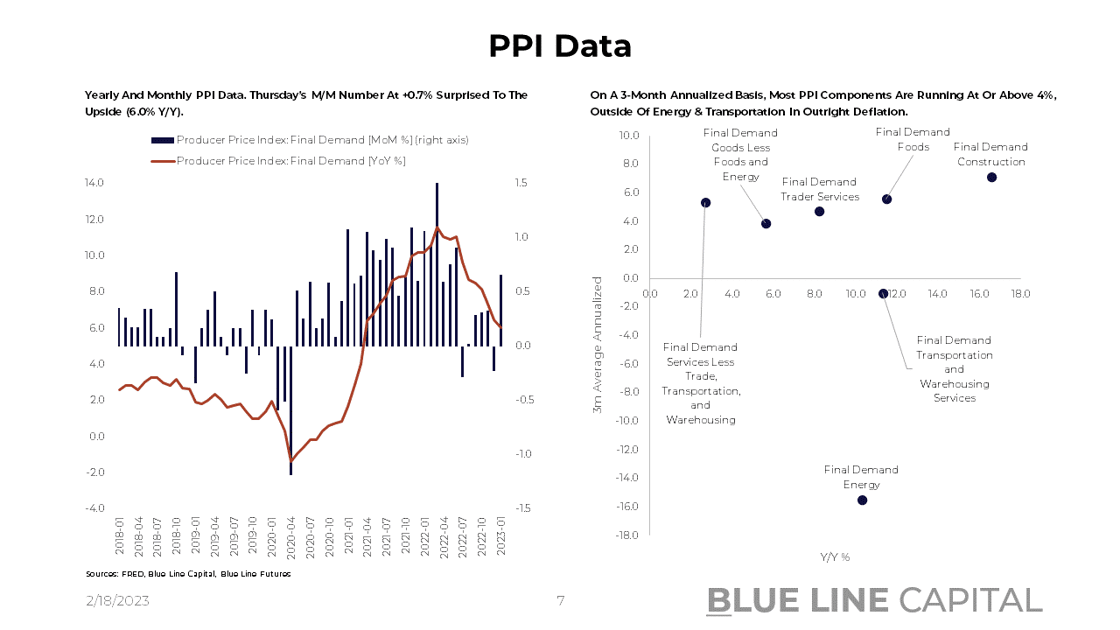

3.) PPI surprised to the upside at 0.7% vs. 0.4% M/M expected. Core-PPI was also higher than forecast, coming in at 0.5% vs. 0.3%. While a yearly comparison of 6% does constitute a decline off of a high base last year, 3-month annualized numbers are much more concerning. Final demand for food is trailing off on a yearly comparison but annualizes to 5.6% over the last 3 months. Trade services have come off substantially but also annualize to 4.7% over the last 3 months. Construction annualizes to 7.2% from November to January.

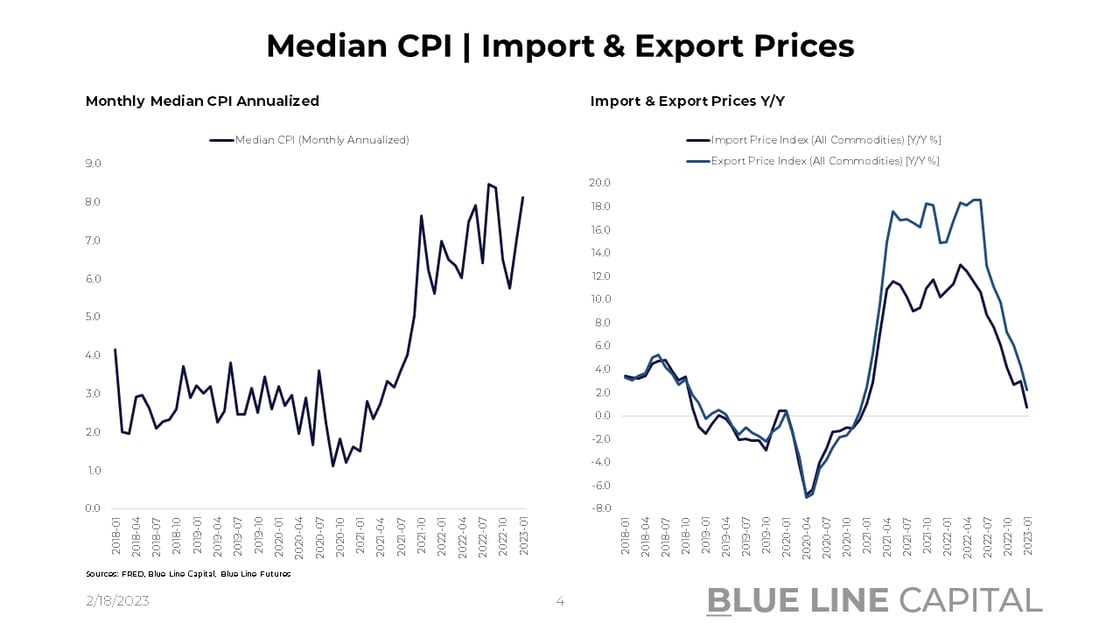

Thus, while yearly numbers are coming in, the monthly annualized numbers point to persistence in higher prices and wages.

As median CPI clocks in at above 8%, small business profits have fallen. As the NFIB's small business survey indicates, small business profits are back to Covid lows while hard data, including hiring and inventory planning, has remained resilient.

Market prices are a result of the opportunity set investors are presented with. The hurdle rate for investors allocating to alternative assets goes up when the risk-free rate jumps to 4.5%, and the equity risk premium collapses when short-term yields rise. The attractiveness of growth assets that promise returns in the distant future while rates are high declines significantly when the Fed needs to keep yields higher for longer. If we are in for a paradigm shift, the next few years might look drastically different from the past. While the default is always a blank sheet of paper, assuming we know very little, one has to wonder if the opportunity set today will lead to a fundamental shift in how asset owners allocate in financial markets.

Don't miss Episode 7 of our Triple Play Podcast -- Bill Baruch and Jannis Meindl share their thoughts on pharma, streaming, and semiconductors.

Be sure to access our weekly chart-pack with everything from credit spreads to in-depth corporate trends in pharma, streaming and chips.

Chart-Pack Macro Slides

Stay tuned for Episode 7 of Triple Play!

Until next time, good luck & good trading.

Be sure to check out prior writing of Top Things to Watch this Week:

- Cognitive Dissonance Pre-CPI - Feb. 12, 2023

- The Fed & Nonfarm Payrolls - Feb. 6, 2023

- Goldilocks Economic Data - Jan. 30, 2023

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (C.T.)

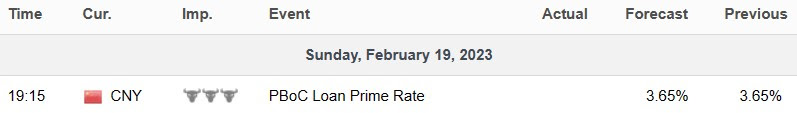

China

Data Release Times (C.T.)

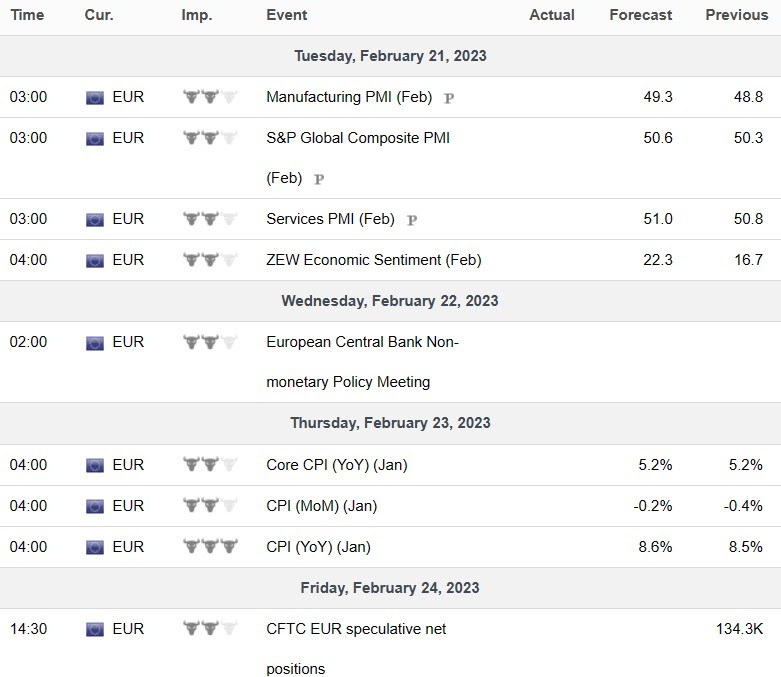

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial