.png)

Cognitive Dissonance Pre-CPI | Top Things to Watch this Week

Posted: Feb. 13, 2023, 7:10 a.m.

"There's a set of mind that is an absolute requirement. If you're not a person whose starting point is "what am I missing?" rather than "how frickin' great am I?" you are missing something essential to survival. "What am I missing?" is like oxygen. If you're asking, "How great am I?" you're the Night of the Living Dead." - Paul Singer

Chart Booklet & More

Access this week's chart booklet leading with housing and wage data. We also cover in-depth corporate trends with AbbVie's Humira patent expiry, Disney in the midst of a streaming war, and Intel caught up in cost cutting.

Bill Baruch joined CNBC's Halftime Report on Thursday. The discussion was wide ranging, including oil, gold and pharma. As his final trade, Bill talked about AbbVie, also covered in this week's chart-pack.

Triple Play Podcast

Don't miss episode 6 of our Triple Play Podcast! Bill Baruch and Jannis Meindl talk about the latest macro trends and share 3 actionable stock ideas.

Macro Dynamics

Credit Markets, Housing, Wages and More

Since there weren't major macro events after an event-driven week last week and CPI next week, I thought it might be best to reflect on where we are in the economic cycle since it's far too easy to forget. It is fair to say that I've been dealing with a whole lot of cognitive dissonance, unclear about where the market gods were going to take us next. But why the confusion?

First, me and many others have gotten accustomed to markets that operate in V shapes. Second, there appears to be an equilibrium of information between bulls and bears. The bulls are banking on inflation continuing to roll over with the Fed returning to its facilitation of ultra-accommodative conditions. On the flipside, the bears point to the yield curve inversion at less than -80bps, which should mean a recession is inevitable.

The highest probability event is, by definition, not the tail outcome. While we might be in for a paradigm shift during which portfolio managers reconstruct and rethink portfolio allocations over long periods of time, the short-term weighs the moods of the day. These moods result in and from money flows affected by the ways in which market makers are positioned, portfolio managers book gains and cut losses, and macro events that create noise around those flows.

Now, if you've read until here, you deserve to see the data that builds and completes the story.

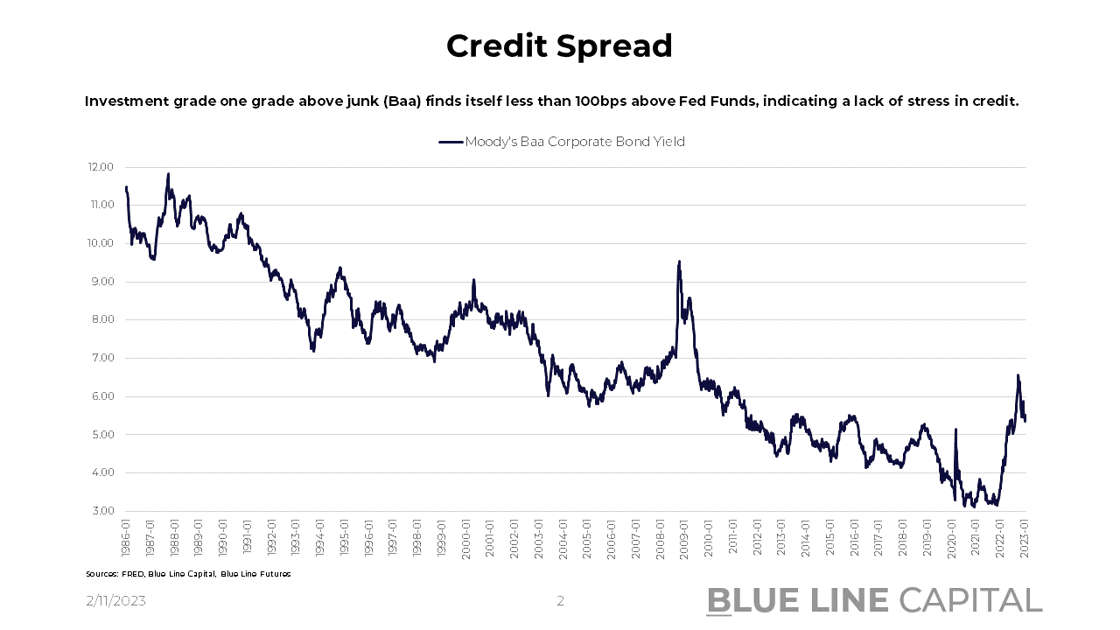

1.) Coming into this year, everyone was looking for the next downside catalyst because as we've learned, prices can stay silly and become sillier until a catalyst leads to a change of mind. As a result, many people turned to credit spreads and signs of capitulation there. The reality, however, is that investment grade bonds one grade above junk are trading at 5.51%. Given that credit markets trade on spreads as a gauge for risk, let's compare the 5.51% against Fed Funds. Compared to Fed Funds, low-quality investment grade only yields 0.94% more than the Fed's overnight rate. For context, during the heights of Covid that blew out to 5%+ and 9%+ during the GFC. While default rates are likely to rise, liabilities on corporate balance sheets got refinanced in 2020 & 2021, leaving corporates in a relatively healthy position for 2023.

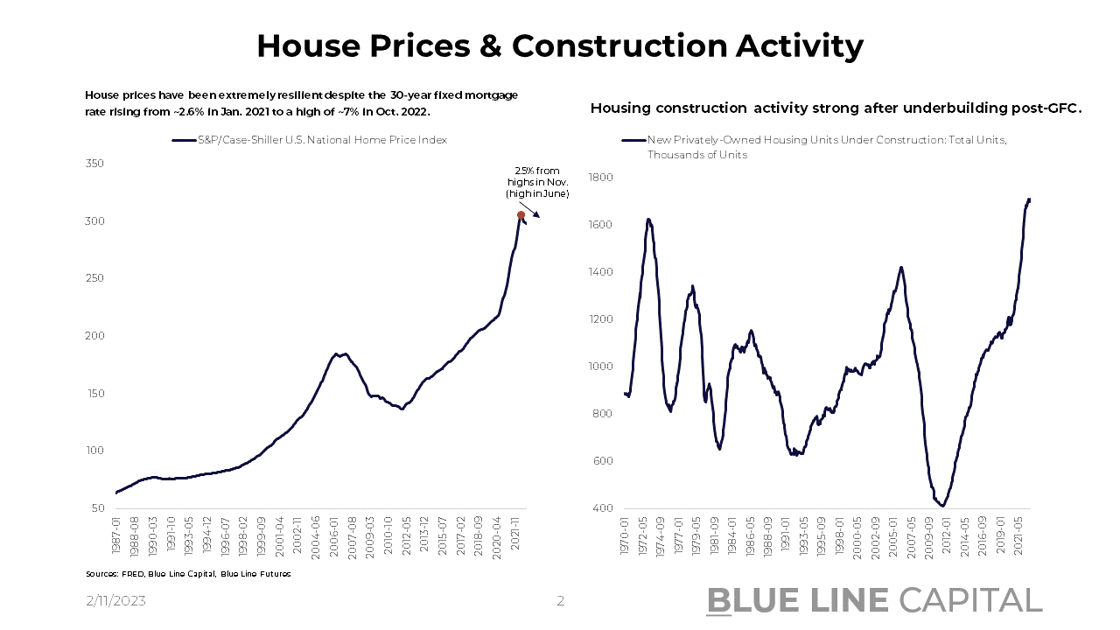

2.) Another theme that hasn't come to fruition is the housing market and the ways in which higher rates would lead to a steep deceleration in real estate. Surely, office REITs have gotten caught in the crossfire of hybrid work, the great migration to the south & south-east, and low cap rates that are still uncompetitive compared to risk-free. Nevertheless, demand for housing units has remained robust with the Case-Shiller housing index off by a mere 2.5% from the high in June. That dynamic has unfolded in the face of 30-year fixed mortgage rates rising from a low of ~2.6% in January 2021 to a local high of ~7% in October. What's more, construction of privately-owned housing units is at record highs since FRED started recording the series in 1970. Thus, while the Fed has pointed to a significant deceleration of real-time rents, the market is underpinned by demographics and migration as a driver. Don't forget, as the population ages, the rate of homeownership goes up.

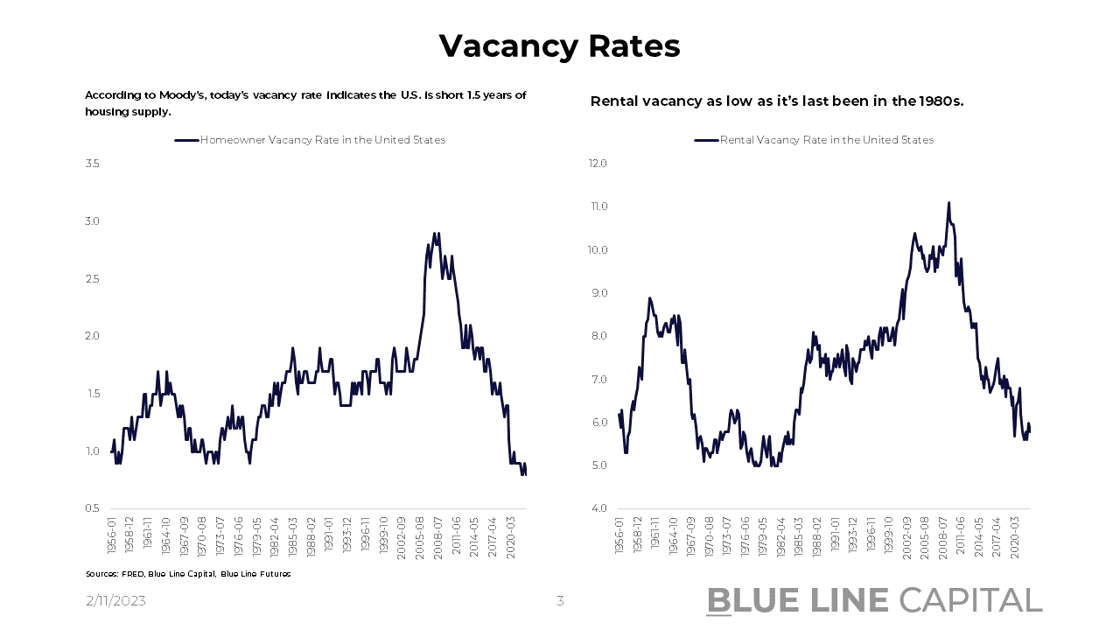

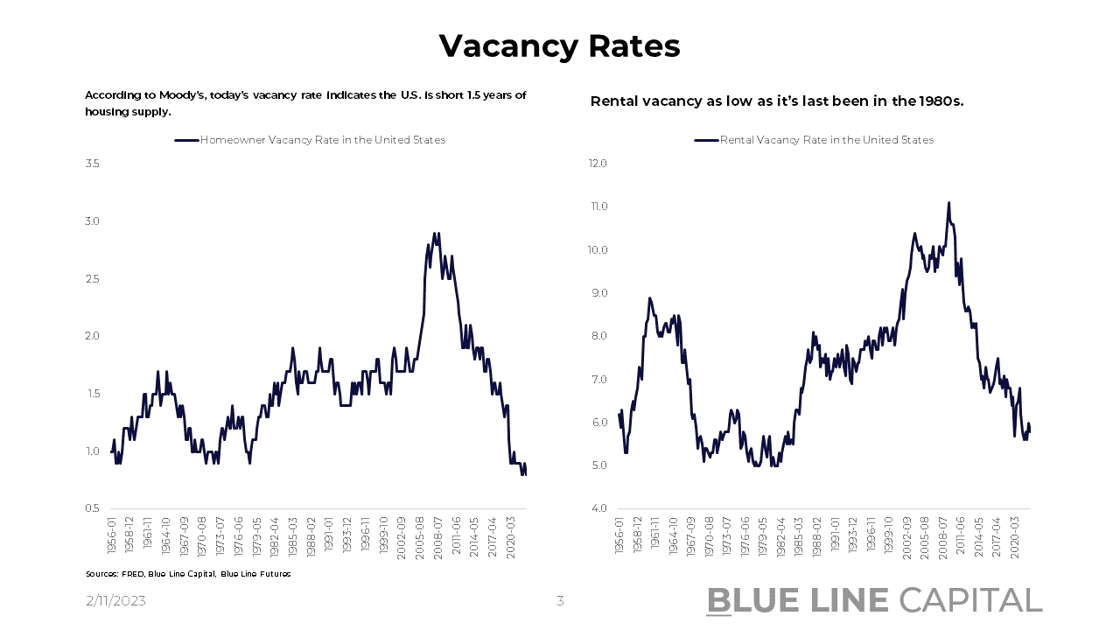

Resulting from the construction shortage on the back of the GFC, homeowner vacancy rates are at record lows with rent vacancy extremely suppressed as well. According to Moody's, today's vacancy rates are indicative of a 1.5years shortfall in housing supply.

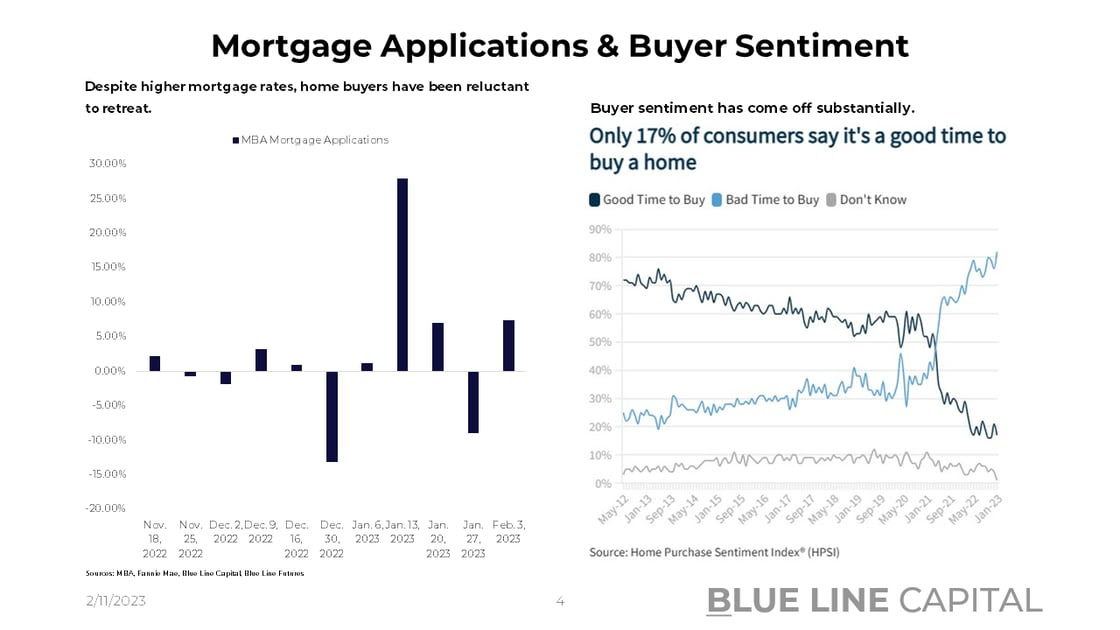

Interestingly, despite mortgage rates up almost 3x since the lows, new mortgage applications measured by the MBA are relatively stable. Mortgage applications have remained resilient despite poor home buyer sentiment, indicating that only 17% of consumers think it's a good time to buy a home.

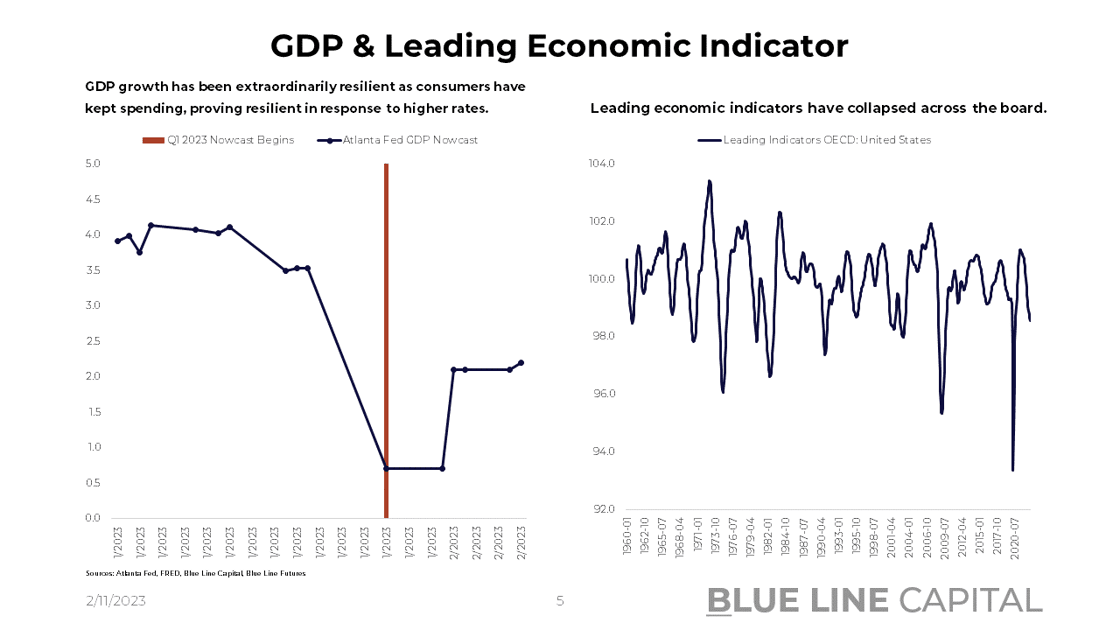

3.) Economic health, which includes the state of housing, is directly affected by consumer spending that hinges on employers' needs to hire and fire. The Atlanta Fed's GDP Nowcast, after a strong Q4, is now indicating 2.2% growth in Q1. Growth is indicated to be strong after credit card companies from Discover to American Express have pointed to low delinquency rates amongst consumers, which in turn leads to increased willingness to grow the loan base. All of the aforementioned factors from housing to consumer spending have defied substantial weakness of leading economic indicators in December of 2022. Are we talking about data distortion amidst post-pandemic normalization getting ready for another recovery, or are we in the early stages of what's yet to be felt given the long and variable lags of monetary policy?

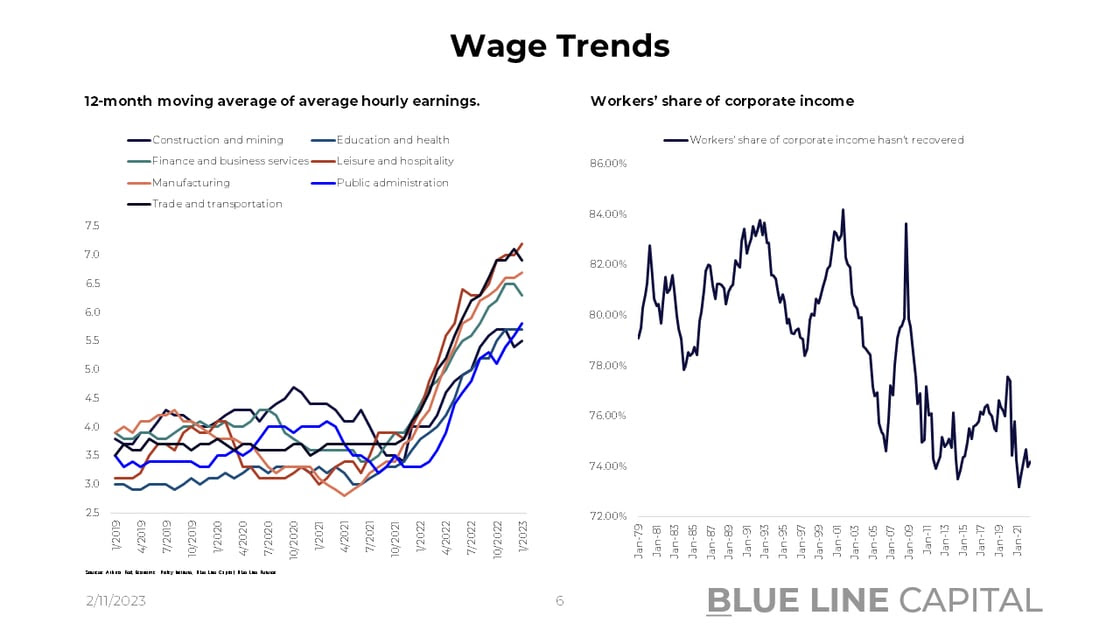

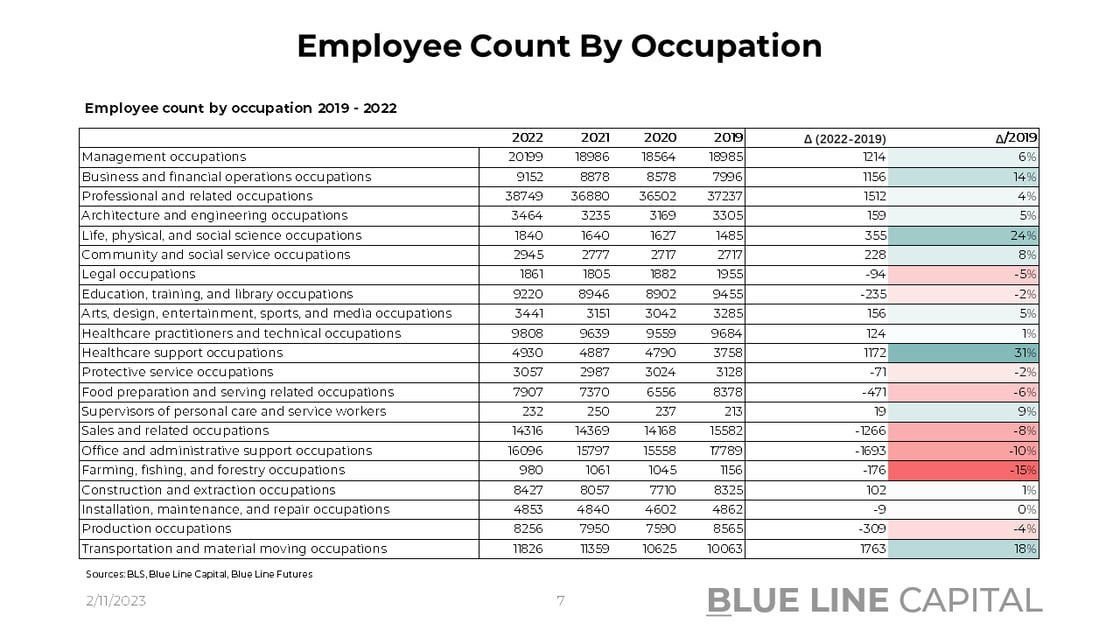

4.) The fourth element of the economy, which the Fed and corporations are concerned with is wages. Wages in almost all areas of the economy are getting ever closer to outpace headline inflation, which in turn means we could start to see real wage gains. Real wage gains may start to occur in the thick of a fundamental shift in terms of how income gets allocated between capital and labor. Since 1979, workers' share of corporate income has steadily declined. As companies deal with labor availability problems while they keep reshoring, more income may have to get allocated towards workers' wages. Interestingly enough, the bureau of labor statistics' data does not echo labor availability concerns. In fact, "only" 8 out of 21 occupation categories had a lower headcount of workers in 2022 compared to 2019. I will have to do some more thinking on this one and keep you posted in the coming weeks.

If markets are dealing with the same cognitive dissonance I am, trimming and adding on the margin is the default for traders & investors. Without another financial crisis type event, catalysts may be few even though we will keep our eyes out for a new impetus that in turn could lead to accelerated price action. The reality is that historical bear markets have played out over long time frames, with some of them just chopping along. Ironically, when we hear "bear market", we default to Covid and the GFC.

Don't miss Episode 6 of our Triple Play Podcast -- Bill Baruch and Jannis Meindl share their thoughts on mega-cap tech and much more!

Be sure to access our weekly chart-pack with everything from credit spreads to in-depth corporate trends in pharma, streaming and chips.

Chart-Pack Macro Slides

Stay tuned for Episode 7 of Triple Play!

Until next time, good luck & good trading.

Be sure to check out prior writing of Top Things to Watch this Week:

- The Fed & Nonfarm Payrolls - Feb. 6, 2023

- Goldilocks Economic Data - Jan. 30, 2023

- Is Growth Following Inflation Lower? - January 23, 2023

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

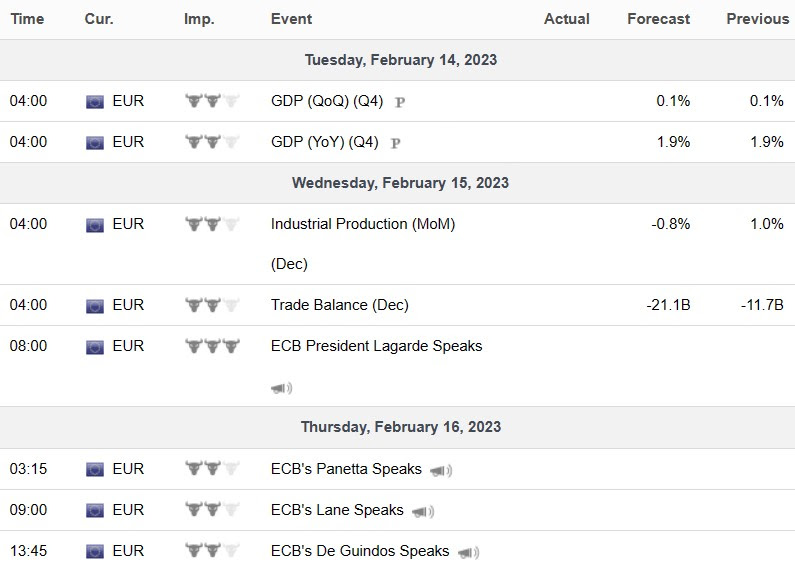

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial