.png)

Goldilocks Economic Data | Top Things to Watch this Week

Posted: Jan. 30, 2023, 5:53 p.m.

Goldilocks Economic Data

"All know the way, few actually walk it." - Bodhidharma

Chart Booklet

Access this week's chart booklet leading with a decomposition of the latest GDP Report, Jobless Claims, and Personal Consumption Expenditures. We also cover in-depth corporate trends as we share insights on McDonald's, Deckers Outdoor, and ServiceNow.

Triple Play Podcast

Don't miss the fourth episode of our Triple Play Podcast! Bill Baruch and Jannis Meindl talk about the latest macro trends and share 3 actionable stock ideas.

GDP Breakdown, Jobs & Inflation

GDP Rundown

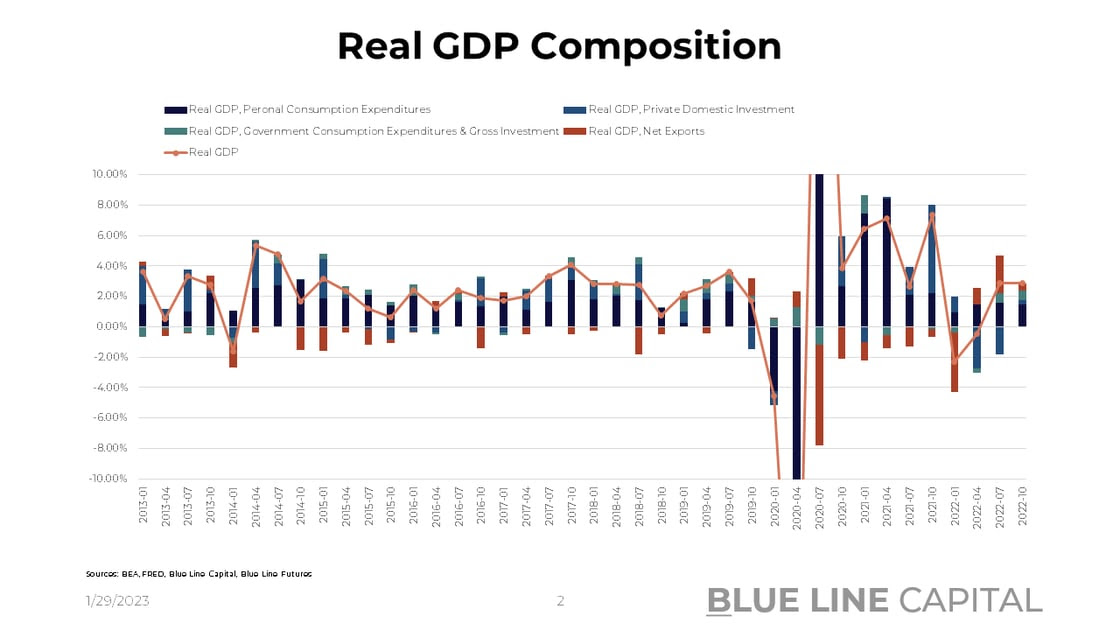

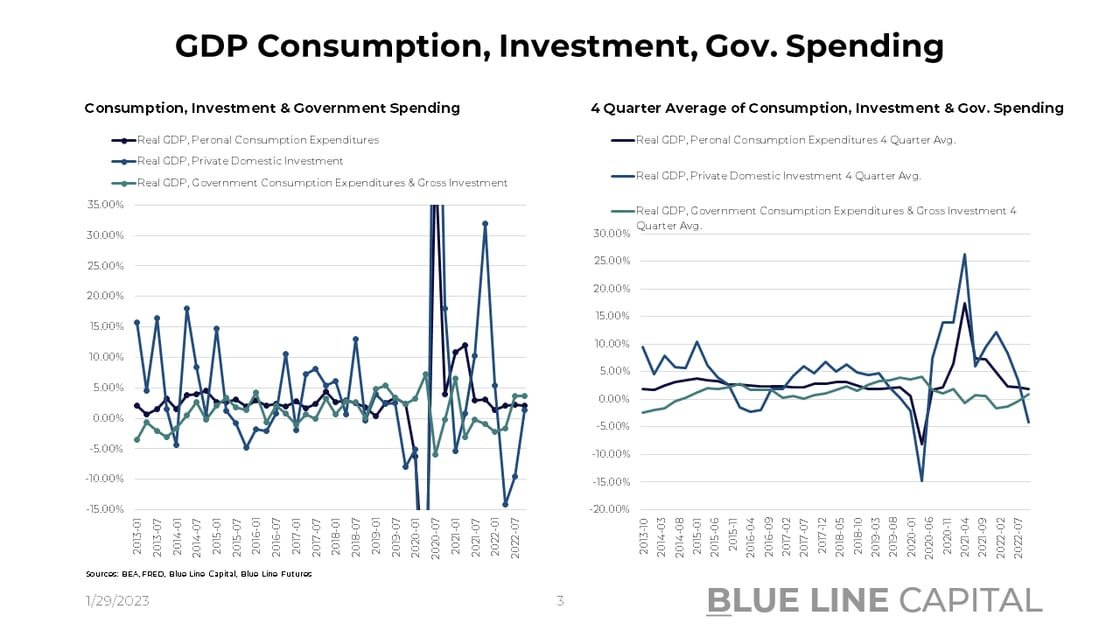

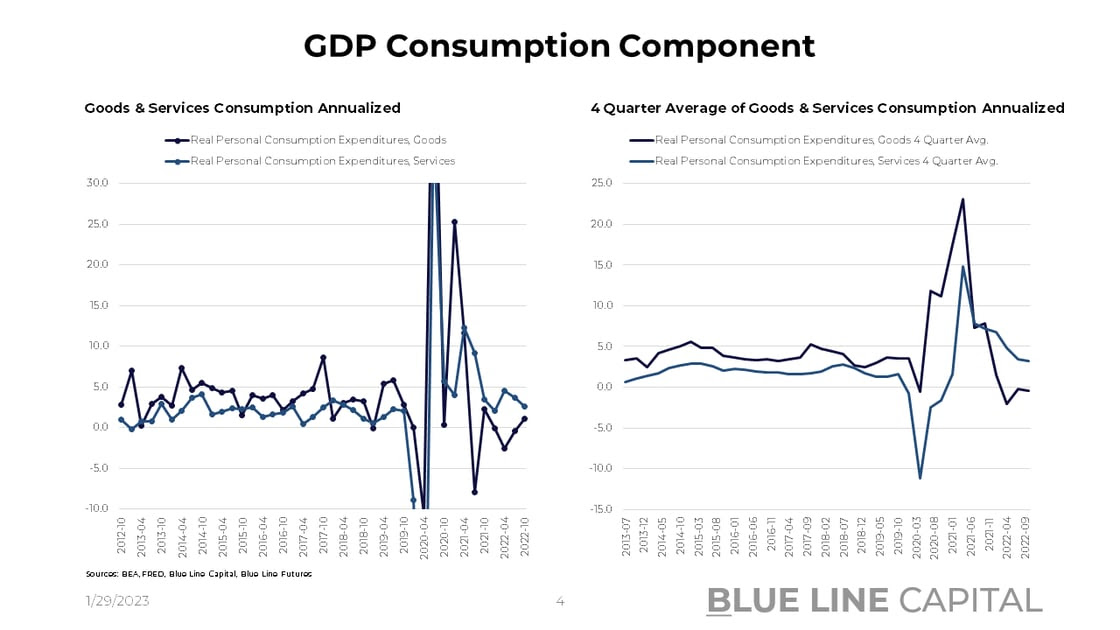

Much of the investor talk in the latter half of 2022 revolved around economic contraction of some sort. On Thursday, that thesis was disconfirmed as Q4 2022 real GDP came in at 2.9%. While higher inventory levels contributed ~1.5% to headline, the consumer remains in healthy shape despite concerning credit card spending trends. While a deceleration from Q3, 1.48% annualized consumer spending is clearly not recessionary. Looking at the components of consumption, goods came in at 1.1% annualized (4 Quarter average of -0.5%) with services at 2.6% (4 Quarter average of 3.2%)

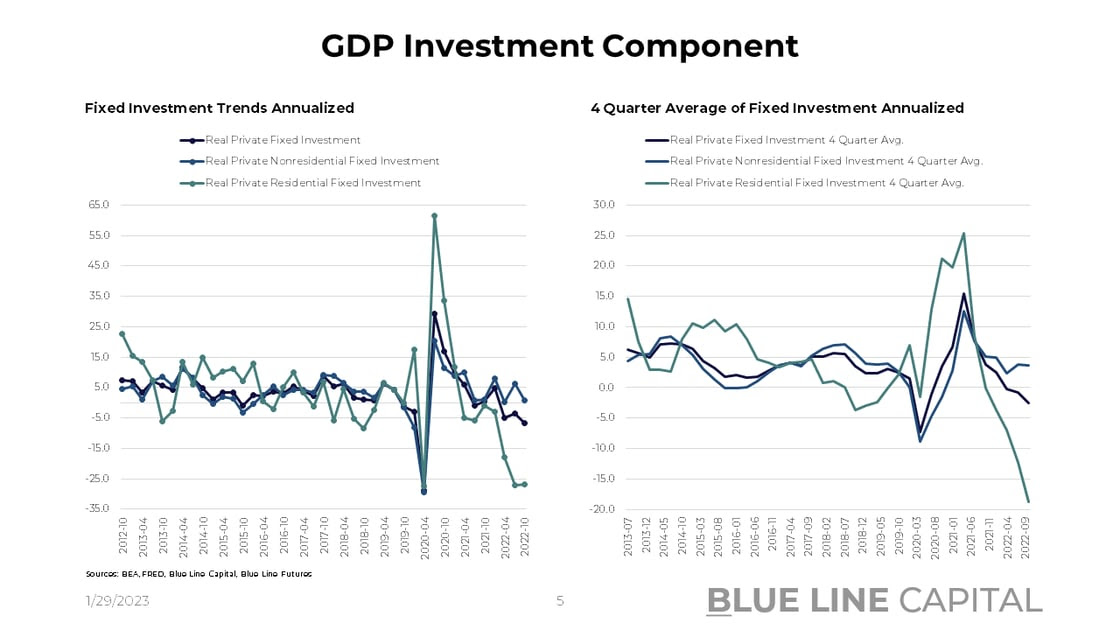

Private domestic investment, a proxy for spending by corporations, also accelerated from -9.58% in Q3 to 1.44% in Q4. Given the data series is a noisy one, the 4-quarter average gives us a better sense about existing trends. -4.22% on average over the last 4 quarters is not encouraging, especially as real private fixed investment decelerated to -6.7% last quarter. Companies are running leaner and aren’t eager to invest in property, plant & equipment. Reflective of the slowdown in real estate, residential fixed investment didn’t decelerate but remained suppressed at -26.7% in Q4 (-27.1% in Q3). If housing supply is coming online – as shown last week, - and rates settle in just a bit, housing activity may return sooner than the Fed may be hoping for, though (some house price indicators suggest prices are only ~1% off July highs.)

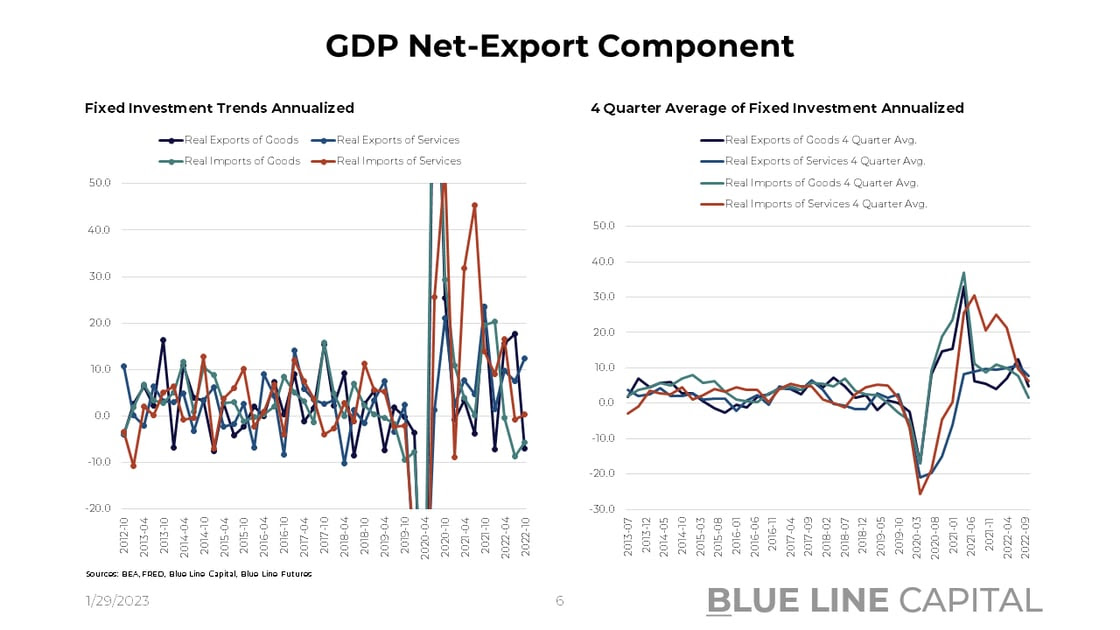

Net export components slowed any way you slice it. Goods exports slowed from 12.4% in Q3 to 4.8% in Q4; services exports also slowed from 10.6% in Q3 to 7.8% in Q4. Goods imports coming in at 1.4% in Q4 compared to 7.7% in Q3. Services imports from 9.7% in Q3 to 6.3% in Q4.

Don't miss Episode 4 of our Triple Play Podcast -- Bill Baruch and Jannis Meindl share their thoughts on recent inflation data.

Durable Goods, Jobless Claims & PCE Data

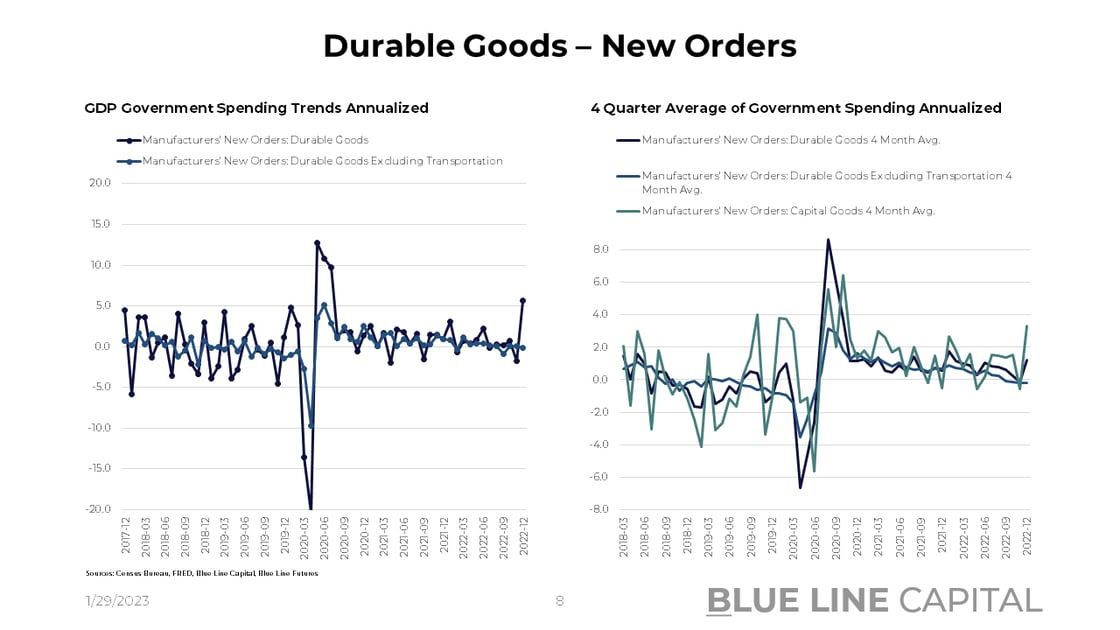

Durable goods – new orders were reported at 5.6% M/M. Not only did the number exceed expectations, but also defied the odds against a slowdown in goods spending. Nevertheless, excluding transportation from where most of the number’s gains came from, durable goods came in at -0.1% M/M. New orders for capital equipment showed strength at 15.8% (vs. -4.5% in Nov.) along with transportation at 16.7% (vs. -5.0% in Nov.). Having said that, we are dealing with noisy data.

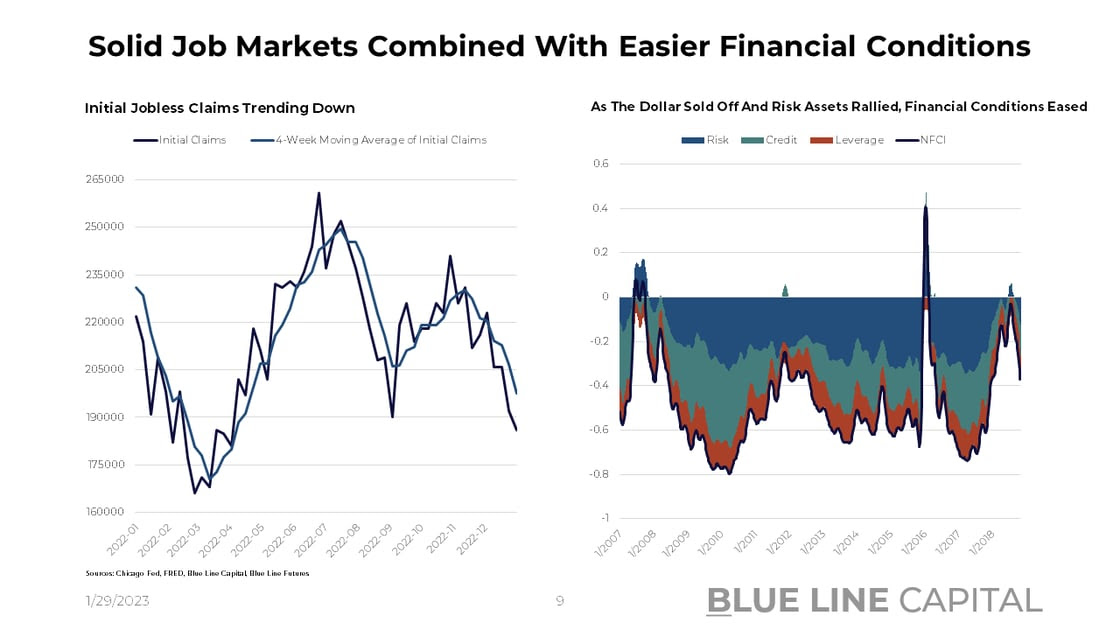

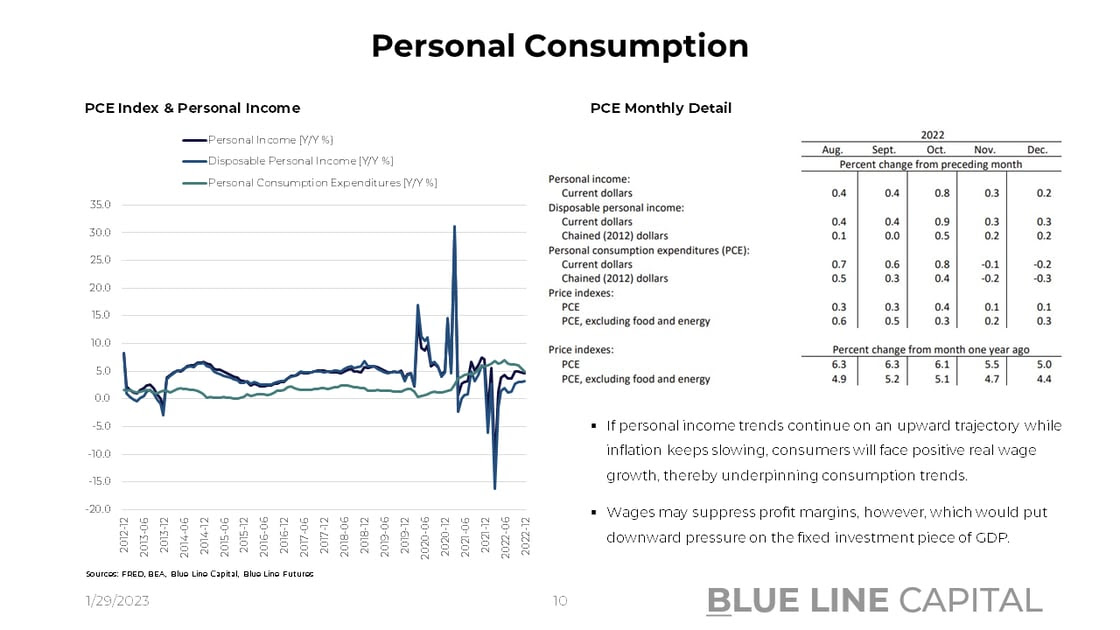

Rounding off strength in the economy, initial jobless claims came in at 186k (vs. 190k the prior week) with the 4-week average now at 197.5k. The tightness in the labor market does not suggest a slowdown despite constant layoff announcements. Even more importantly, perhaps, personal consumption expenditures inflation and personal income are converging. With PCE at 0.1% M/M and core-PCE at 0.3% M/M, it compares rather favorably to personal income at 0.2% M/M and disposable personal income at 0.3% M/M. If income remains stable as workers continue to renegotiate wages higher, workers with positive real wage gains will ultimately spend and therefore keep the economy going.

If incomes rise - but not too much for prices to start trending higher again, - and inflation slows, we are talking about goldilocks economic data. How long can that dynamic sustain itself if the housing market reemerges and wages call for more monetary action?

Be sure to access our weekly chart-pack with everything from GDP to corporate highlights.

Chart-Pack Macro Slides

Stay tuned for Episode 5 of Triple Play!

Until next time, good luck & good trading.

Be sure to check out prior writing of Top Things to Watch this Week:

- Is Growth Following Inflation Lower? - January 23, 2023

- A Renormalization on Wall Street - January 16, 2023

- What Cards Does Wall Street Hold? - January 9, 2023

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

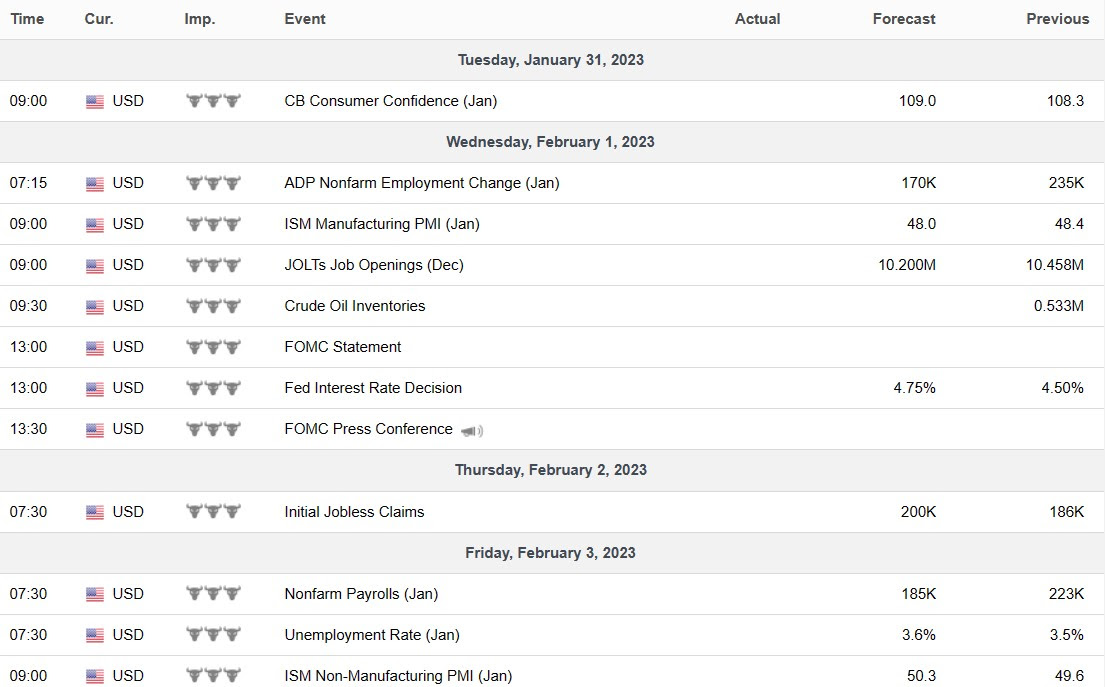

Economic Calendar

U.S.

Data Release Times (C.T.)

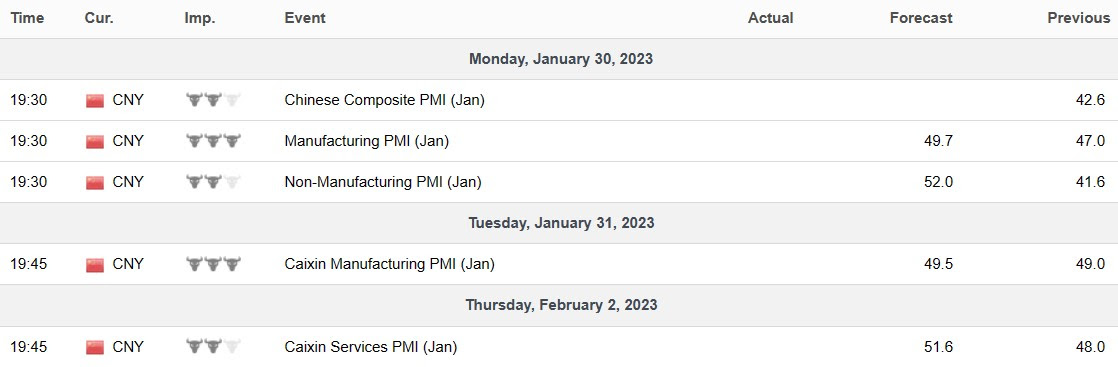

China

Data Release Times (C.T.)

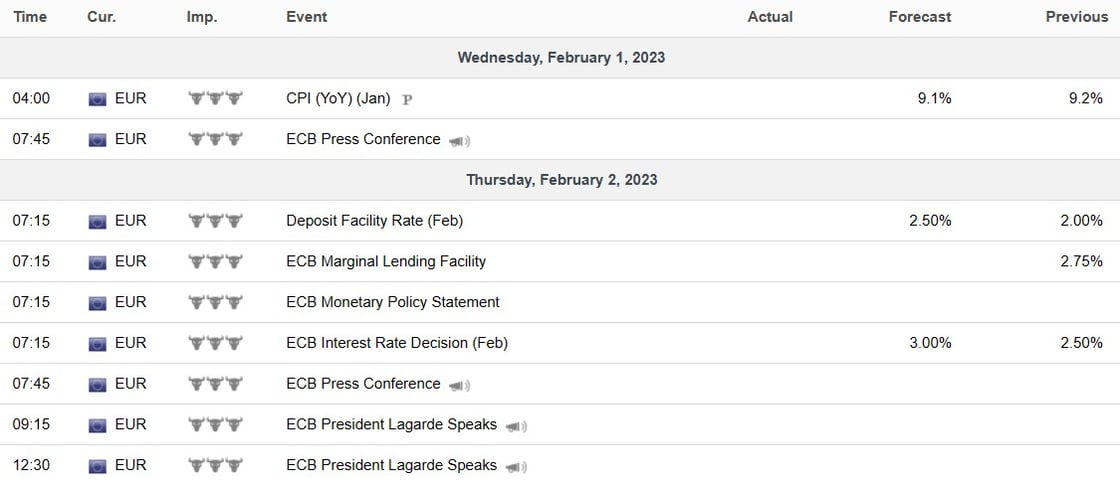

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial