What Cards Does Wall Street Hold? | Top Things to Watch this Week

Posted: Jan. 9, 2023, 8:42 a.m.

What Cards Does Wall Street Hold?

"By endurance we conquer." - Ernest Shackleton

Chart Booklet

Access this week's chart booklet leading with recent Nonfarm Payrolls wage data, followed by an in-depth look at corporate trends. This week, we cover S&P Global, MasTec, and Cognex.

Triple Play Podcast

Don't miss the first episode of our Triple Play Podcast! Bill Baruch and Jannis Meindl talk about the macro landscape in connection to 3 stocks in AI, automation and energy. Stay tuned for episode 2 this week!

Jobs, Wages & China

U.S. Jobs & Wage Data

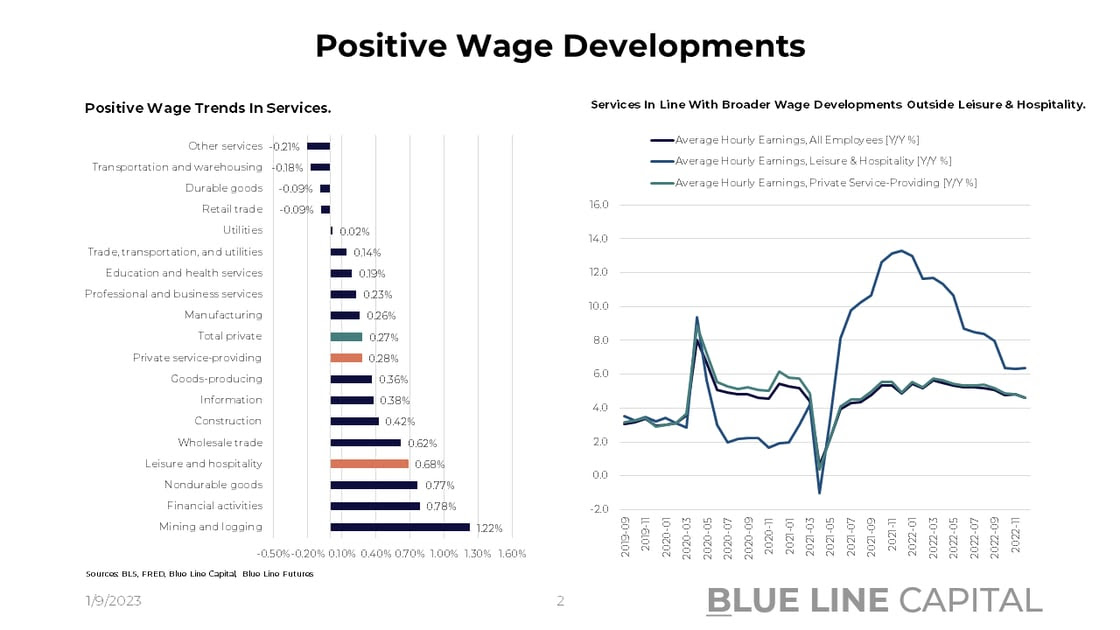

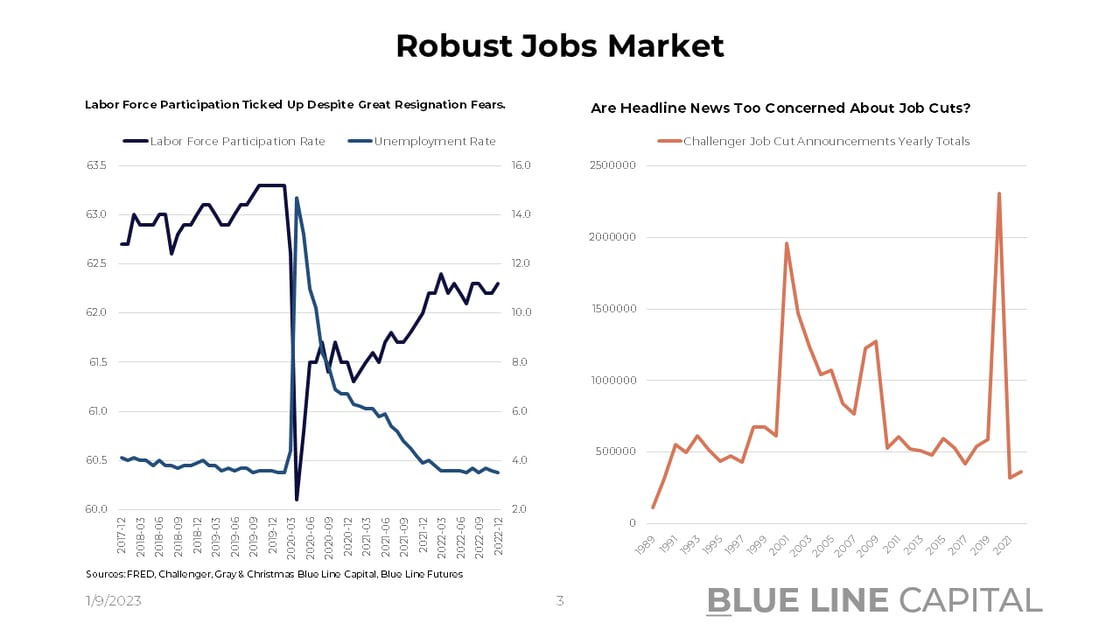

Markets are in a tug of war against central bank liquidity drying up while hard economic data remains somewhat buoyant. Nevertheless, ISM Services was in contraction territory last week, moving one step closer to the recession playbook. Arguably, that's exactly what the Fed needs and wants to see. Unemployment at 3.5% with labor force participation ticking up by 0.1% is a goldilocks scenario, especially as wages came in soft at 0.3%. Perhaps more encouraging amidst +223k jobs added is the fact that wages on the services side stayed contained outside of leisure & hospitality.

Thus, markets are caught in between two forces: 1.) Central banks fighting inflation until they're certain the 2% average inflation target can be hit. 2.) The economy is renormalizing on its own, which will likely take time.

Whether the Fed and other central banks will pressure markets into a state where inflation is much lower, or the economy renormalizes by itself will matter a whole lot for risk assets. A risk free rate at 4% would be a problem if it were to stay here and therefore challenge the very idea of running war-time deficits in peace time, but there are a lot of assumptions flowing into that thesis.

Macro slides on page 2 - 4 in our chart pack.

A decrease in the more resilient component of inflation (wages) goes hand-in-hand with recent fears over the great resignation. While there may certainly be some truth to that structural force, the last NFP report offered a sigh of relief.

Less encouraging is the tightness of the job market as far as the eye can see. Despite daily reports about layoff announcements, challenger job cuts show a slight uptick in layoff announcements in 2022 compared to 2021. This is very similar to the dynamic we're seeing with initial jobless claims staying extraordinarily resilient.

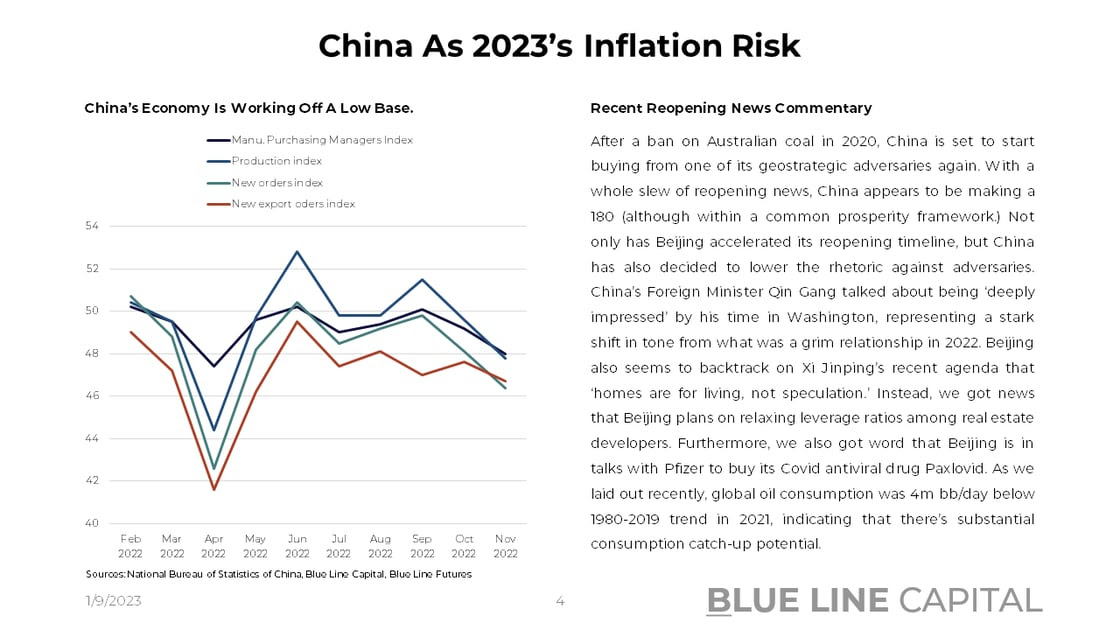

China Reopening Acceleration

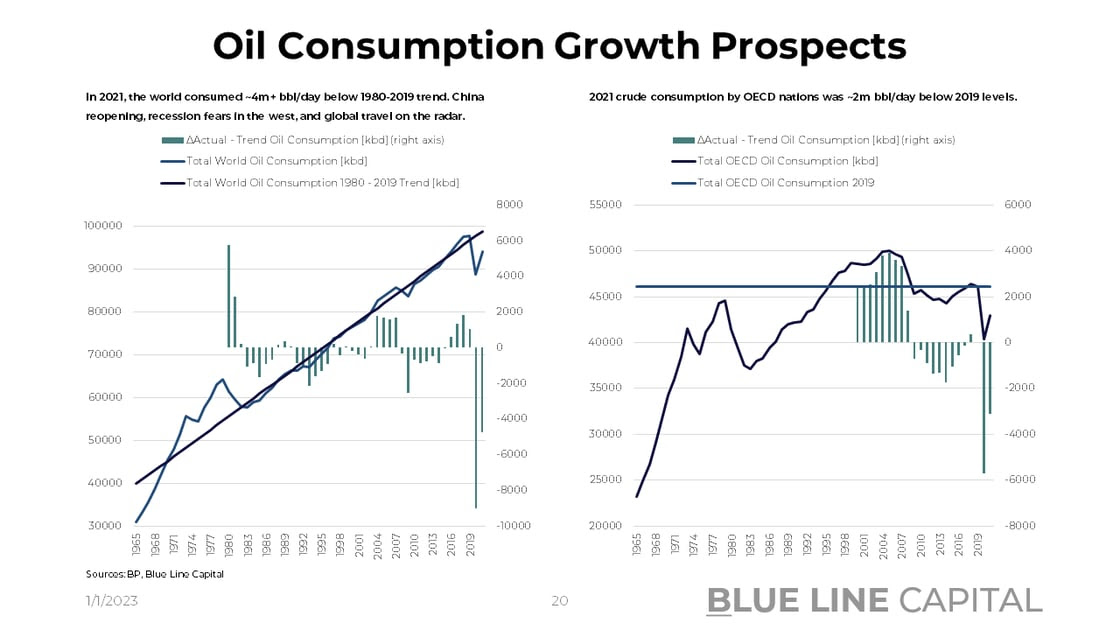

After a ban on Australian coal in 2020, China is set to start buying from one of its geostrategic adversaries again. With a whole slew of reopening news, China appears to be making a 180 (although within a common prosperity framework.) Not only has Beijing accelerated its reopening timeline, but China has also decided to lower the rhetoric against adversaries. China’s Foreign Minister Qin Gang talked about being ‘deeply impressed’ by his time in Washington, representing a stark shift in tone from what was a grim relationship in 2022. Beijing also seems to backtrack on Xi Jinping’s recent agenda that ‘homes are for living, not speculation.’ Instead, we got news that Beijing plans on relaxing leverage ratios among real estate developers. Furthermore, we also got word that Beijing is in talks with Pfizer to buy its Covid antiviral drug Paxlovid. As we laid out recently, global oil consumption was 4m bb/day below 1980-2019 trend in 2021, indicating that there’s substantial consumption catch-up potential.

If China imports more commodities while accelerating its exports of consumer goods, it's not entirely clear whether the net impact will be inflationary or disinflationary.

Don't miss the first episode of Triple Play and be sure to access this week's chart pack containing macro and micro data.

Until next time, good luck & good trading.

Be sure to check out prior writing of Top Things to Watch this Week:

- Risk Assets In The Context Of China Reopening & US Macro Data - January 1, 2023

- The State Of Corporate America - December 27, 2022

- Monetary Tightness Continues - December 18, 2022

Our Blue Line Futures Trade Desk is here to talk about positioning, idea and strategy generation, assisted accounts, and more! Don't miss our daily Research with actionable ideas (Click Here To Sign Up)

Schedule a Consultation or Open your free Futures Account today by clicking on the icon above or here. Email info@BlueLineFutures.com or call 312-278-0500 with any questions!

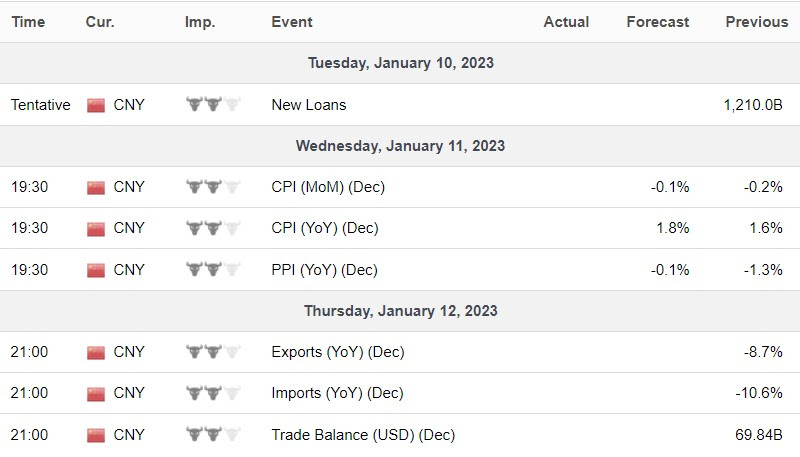

Economic Calendar

U.S.

Data Release Times (C.T.)

China

Data Release Times (C.T.)

Eurozone

Data Release Times (C.T.)

More Of The Upcoming Economic Data Points Can Be Found Here.

Food for Thought

Blue Line Capital

If you have questions about any of the earnings reports, our wealth management arm, Blue Line Capital, is here to discuss! Email info@bluelinecapllc.com or call 312-837-3944 with any questions! Visit Blue Line Capital's Website

Sign up for a 14-day, no-obligation free trial of our proprietary research with actionable ideas!

Free Trial

Start Trading with Blue Line Futures

Subscribe to our YouTube Channel

Email info@Bluelinefutures.com or call 312-278-0500 with any questions -- our trade desk is here to help with anything on the board!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Like this post? Share it below:

Back to Insights

In case you haven't already, you can sign up for a complimentary 2-week trial of our complete research packet, Blue Line Express.

Free Trial